Takeaways:

·MPI report projects declining China steel demand, led by a sharp construction slowdown in 2025.

·Machinery and auto industries provide growth resilience, while trade-reliant sectors like containers plunge.

·Overall contraction narrows in 2026, highlighting a bottoming-out trend.

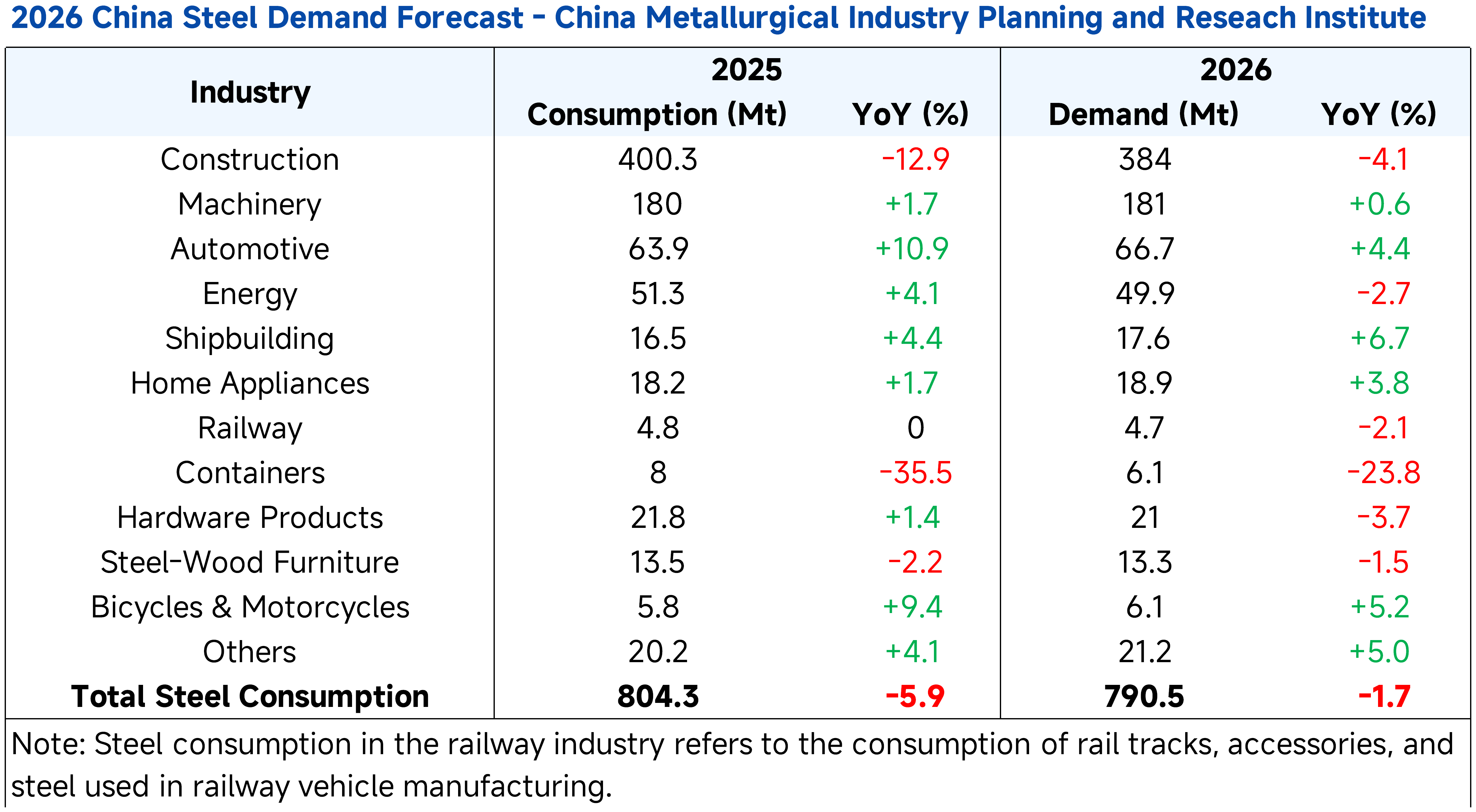

The 2026 Domestic and Global Steel Demand Forecast Report released by the Metallurgical Industry Planning and Research Institute (MPI) in Beijing on the 19th shows that China's steel consumption is projected to be 808 million tons in 2025, a YoY decrease of 5.4%, while demand is expected to reach 800 million tons in 2026, down 1.0% YoY.

Globally, the report predicts that steel consumption will total 1.719 billion tons in 2025, a decline of 1.8% YoY, and global steel demand will reach 1.736 billion tons in 2026, an increase of 1.0% compared to the previous year.

In 2025, China's overall steel consumption declined due to insufficient domestic demand, particularly the profound adjustments in the real estate market.

By sector, the construction industry, as the core area of steel consumption, performed weakly in 2025 due to multiple factors. On the one hand, key indicators such as newly started housing construction area and construction-in-progress area continued to decline, directly reducing the foundational demand for steel in construction. On the other hand, investments in transportation infrastructure such as highways and waterways also decreased, further shrinking steel consumption. Overall, steel consumption in the construction industry in 2025 was approximately 400.3 million tons, a significant YoY decline of 12.9%. It is expected that this sector will remain in an adjustment phase in 2026, with consumption projected to be around 384 million tons, a decline of 4.1% YoY, though the rate of decline will be significantly narrower compared to 2025.

The machinery industry demonstrated strong resilience in 2025, becoming a key driver supporting steel consumption. According to industry operating data, the added value of the machinery industry from January to October 2025 increased by 6.1% YoY, significantly higher than the national industrial and manufacturing averages during the same period. The traditional machinery equipment market remained relatively stable, while demand for equipment upgrades in certain sectors gradually materialized, collectively driving steel consumption in the machinery industry to 180 million tons in 2025, a YoY increase of 1.7%.

Driven by policy dividends, the automotive industry emerged as a bright spot for steel consumption growth in 2025. The combined effects of China’s "Two New" (new energy, new materials) policy and local automobile replacement subsidies effectively stimulated the vitality of the automotive consumer market. In particular, the continued increase in the penetration rate of new energy vehicles drove steady growth in automobile production, thereby boosting steel demand. Steel consumption in the automotive industry reached 63.9 million tons in 2025, a substantial YoY increase of 10.9%, making it one of the fastest-growing major sectors.

Steel consumption in other key industries also showed significant divergence. In 2025, the container industry, affected by weak global trade, saw a sharp decline in steel consumption of 35.5% YoY, mainly due to a sharp drop in container demand caused by reduced international trade activity. It is expected that global trade conditions will improve slightly in 2026, but overall activity will remain low.

In the shipbuilding industry, as the global shipping market gradually recovered in 2025, the number of ship orders increased, leading to a YoY growth of 4.4% in steel consumption. In the household appliance industry, steel demand remained relatively subdued in 2025, with a YoY growth rate of only 1.7%, mainly due to weak market demand.

From an overall development trend perspective, China's steel consumption in 2025–2026 exhibited significant sectoral divergence. The construction industry continued to adjust, while the machinery and automotive industries maintained growth, albeit at varying rates. Sectors such as containers remained in a low phase of development, highlighting the increasingly prominent "structural" consumption characteristics. Meanwhile, the overall decline in steel consumption narrowed from 5.9% in 2025 to 1.7% in 2026, indicating that domestic demand is gradually bottoming out.

| Index | RMB/t | DoD | Basis | Date |

|---|---|---|---|---|

| Datong 5500 | ex-mine | 07-01 | ||

| Shuozhou 5200 | FOR | 07-01 | ||

| Ordos 5500 | ex-mine | 07-01 | ||

| Yulin 6200 | ex-mine | 07-01 | ||

| Liulin Low-sulphur | ex-mine | 07-01 | ||

| Gujiao Low-sulphur | FOR | 07-01 | ||

| Xingtai Low-sulphur | ex-Factory | 07-01 | ||

| Yangquan PCI | FOR | 07-01 |

| Index | RMB/t | WoW | WoW% | Date |

|---|---|---|---|---|