By Ruoxin

Aug 18, 2025

Edited and Updated by Ethan Ma

Aug 18, 2025

In Brief:

·Improved macro outlook and policies boosted market confidence.

·Supply tightened amid inspections, weather, and shrinking imports.

·Steel demand and rising coke prices fueled stronger coal rebound.

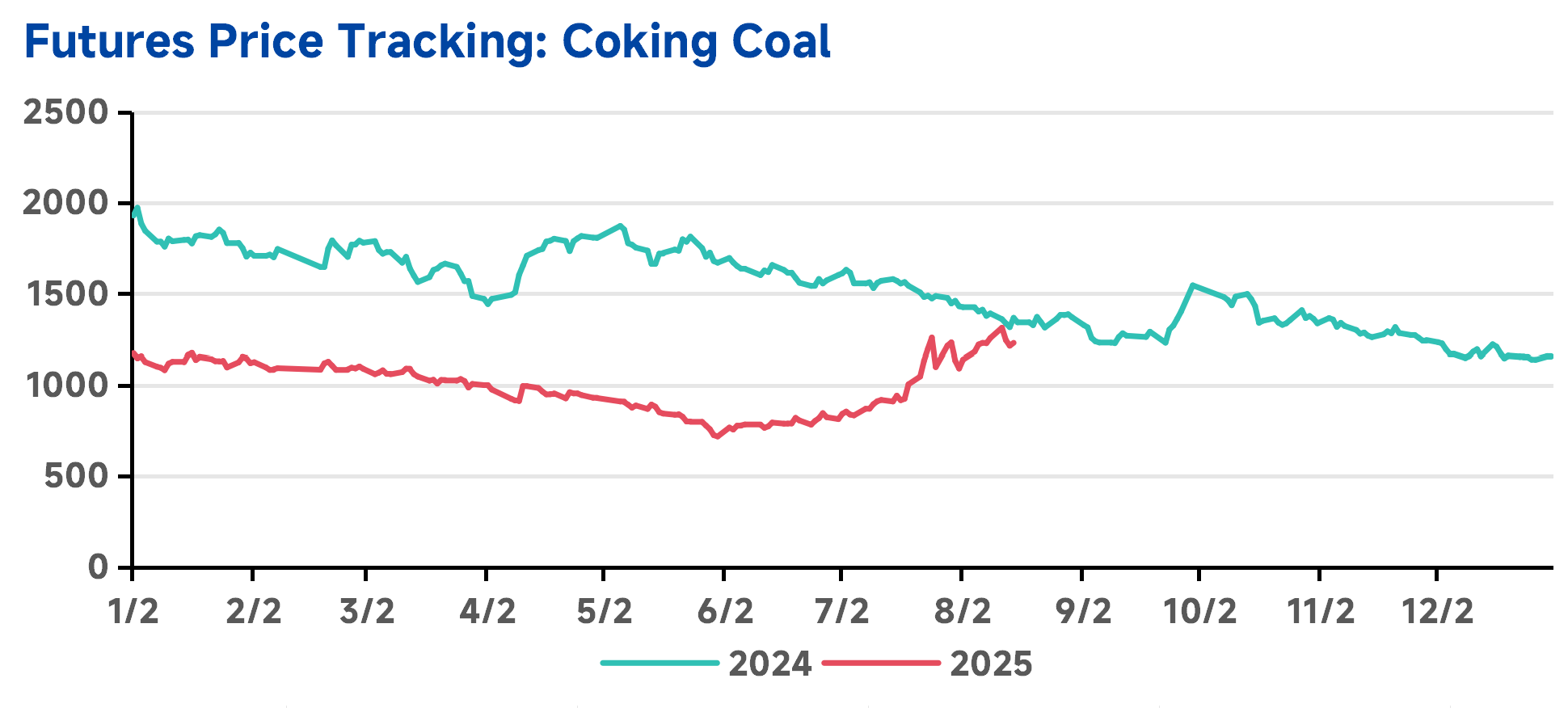

Since July, the coking coal market has shaken off the weakness and slump of the first half of the year, with futures surging, spot prices rising, and a once-depressed market reigniting. Coking coal futures responded earliest and fastest: after a sharp rebound began on June 4, sentiment at the industry end remained pessimistic. By late July, futures gains turned into a powerful rally with consecutive limit-ups. Although recent trading has seen some fluctuations, market sentiment has clearly warmed, and with additional policy-driven support, prices remain firm.

CCTD China Coal Market Network is one of the most trusted coal industry think tanks in China, providing exclusive and extensive data coverage.

I. Where is this market rally coming from?

1. Improved macro expectations and steady growth in China’s economy.

China’s GDP grew 5.3% in the first half of the year, beyond expectations. The China-U.S. trade war did not escalate, with additional tariffs delayed again. The government has rolled out monetary and fiscal measures to support capital markets and the real economy. Macro expectations have shifted fundamentally, boosting investor confidence and strengthening belief in China’s economic growth.

2. Government crackdown on “involution” and unfair competition.

With some industries seeing prices plunge below costs and suffering from vicious low-price competition, the 2024 Politburo meeting first stressed preventing “involution-style” competition. This year’s meeting reiterated the need to deepen construction of a unified national market, improve market order, curb disorderly competition, and strengthen capacity controls in key sectors.

3. Safety checks and capacity inspections.

In July, the National Energy Administration launched coal mine inspections in eight provinces including Shanxi and Inner Mongolia. Mines producing more than 10% above their approved capacity in January–June were ordered to suspend operations and rectify.

II. Market Fundamentals determine the extent of the rebound

As the saying goes in commodity markets: the macro outlook sets the bottom, fundamentals determine the height. For coal and coke, fundamentals depend on prices, inventories, and steel demand.

1. Prices fell to extreme lows, triggering a rebound.

Coking coal spot prices hit a five-year low. Shanxi high-sulfur coking coal (S3.0) dropped below 800 yuan/ton, with actual deals around 750 yuan, below cost and loss-making for mines in Hebei, Anhui, Henan and elsewhere. Futures bottomed earlier than spot, also at five-year lows. Excessive decline led to a corrective rebound.

2. Contraction of actual supply.

Shanxi’s June raw coal output was 113.685 million tons, down 1.6% YoY. Cumulative January–June output was 652.007 million tons, up 10.1% YoY. Coking coal output rose nearly 9% YoY in H1, reflecting oversupply earlier this year. But, after June, tighter safety/environment checks plus rainfall cut production: July raw coal output nationwide was 380.99 million tons, down 9.5% from June and 3.8% YoY (June had risen 3%). Falling supply and policies boosted confidence.

3. Inventory shifts signals demand resilience.

Washed coal plants began destocking in early June, followed by coal mines in July, while blast furnace output stayed high. With demand stable, inventories shifted from mines to coking plants. Before, downstream coking coal stocks had shrunk to just 3–5 days—risky levels. With replenishment, stocks recovered to 8–10.5 days, restoring balance.

4. Steel margins improved, supporting higher coal prices.

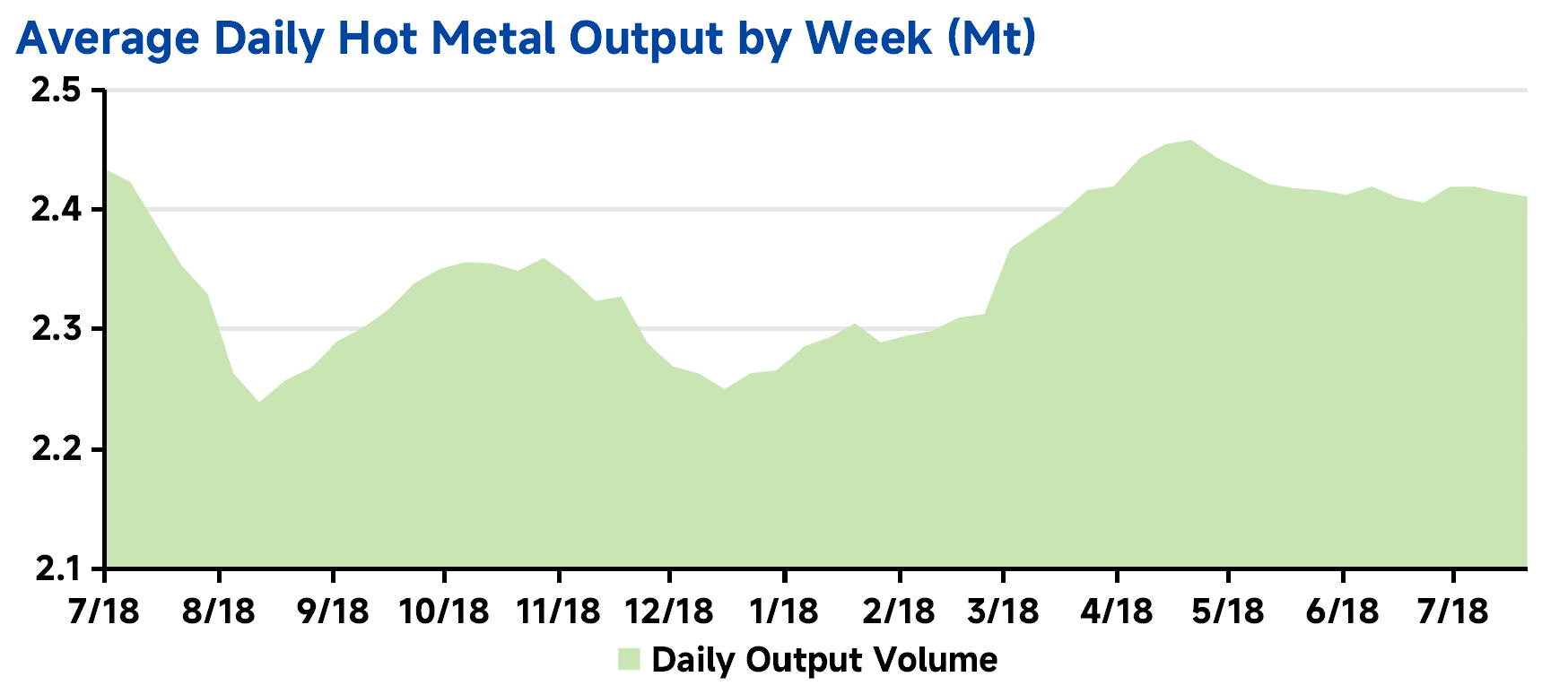

Steelmakers’ profits rose, averaging 150–200 yuan/ton. Since Q2, daily hot metal output has stayed above 2.4 million tons, showing strong steel production and sustaining coal and coke demand.

5. Coke price surges boosted market sentiment.

Since July 17, coke prices have risen in six rounds by a total of 300 yuan, injecting confidence and spurring active trading.

6. Imports down, costs rising.

June coking coal imports totaled 9.1084 million tons, down 15.05% YoY. July coal imports were 35.609 million tons, down 22.9% YoY. Coking coal imports are shrinking, with Mongolian coal inventories at Ganqimaodu port down nearly 200 million tons from February highs. The price of Mongolian #5 coking coal closely tracks fluctuations in domestic futures. Inventories and prices at the Ganqimaodu border port show a very high correlation with the Chinese domestic market.

Outlook

Analysts believe national and Shanxi coal output will stay balanced. Supply declines under capacity checks correct the “volume over price” sales logic. Market attention should focus on output restrictions and environmental controls in northern China around upcoming parades and events. The coking coal market is expected to remain volatile but firm, with low-sulfur, high-CSR coking coal fluctuating around 1,400 yuan/ton.

| Index | RMB/t | DoD | Basis | Date |

|---|---|---|---|---|

| Datong 5500 | ex-mine | 07-01 | ||

| Shuozhou 5200 | FOR | 07-01 | ||

| Ordos 5500 | ex-mine | 07-01 | ||

| Yulin 6200 | ex-mine | 07-01 | ||

| Liulin Low-sulphur | ex-mine | 07-01 | ||

| Gujiao Low-sulphur | FOR | 07-01 | ||

| Xingtai Low-sulphur | ex-Factory | 07-01 | ||

| Yangquan PCI | FOR | 07-01 |

| Index | RMB/t | WoW | WoW% | Date |

|---|---|---|---|---|