China's Two Energy Giants Release Data Revealing Coal Market Pressures

Time:2025-08-14 16:44:40 Source:CCTD

Edited and Updated by Ethan Ma

Aug 14, 2025

In Brief

·Output up, sales and profits under pressure.

·Shenhua cushioned by transport and power.

·Yankuang’s chemicals can’t offset coal slump.

Recently, China’s two listed energy giants, China Shenhua and Yankuang Energy, released their July and H1 2025 operating results, reflecting a coal market facing oversupply and falling price levels. While production has remained stable or even increased, weakening sales, declining prices, and narrowing profit margins are becoming more apparent.

CCTD China Coal Market Network is one of the most trusted coal industry think tanks in China, providing exclusive and extensive data coverage.

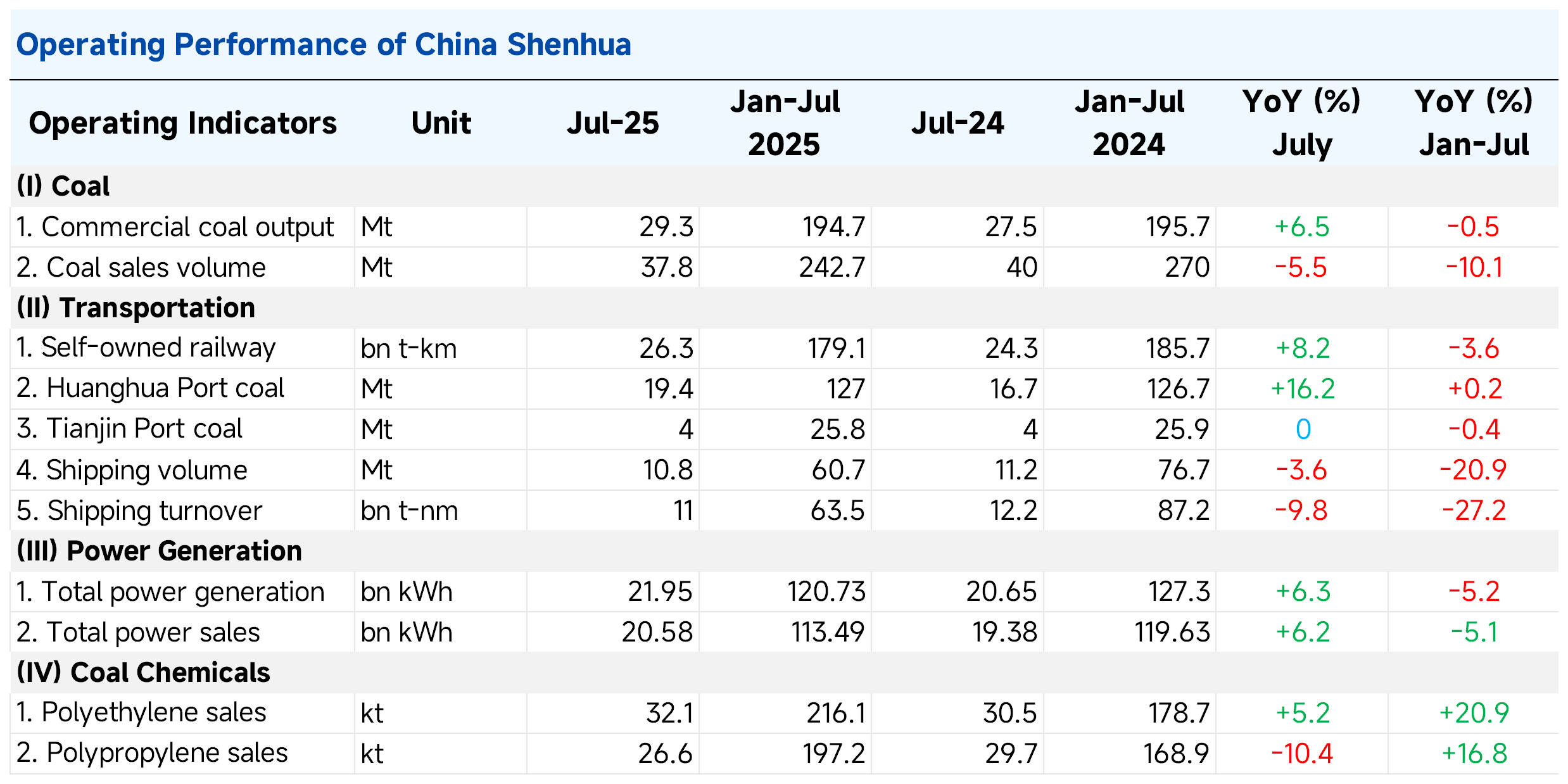

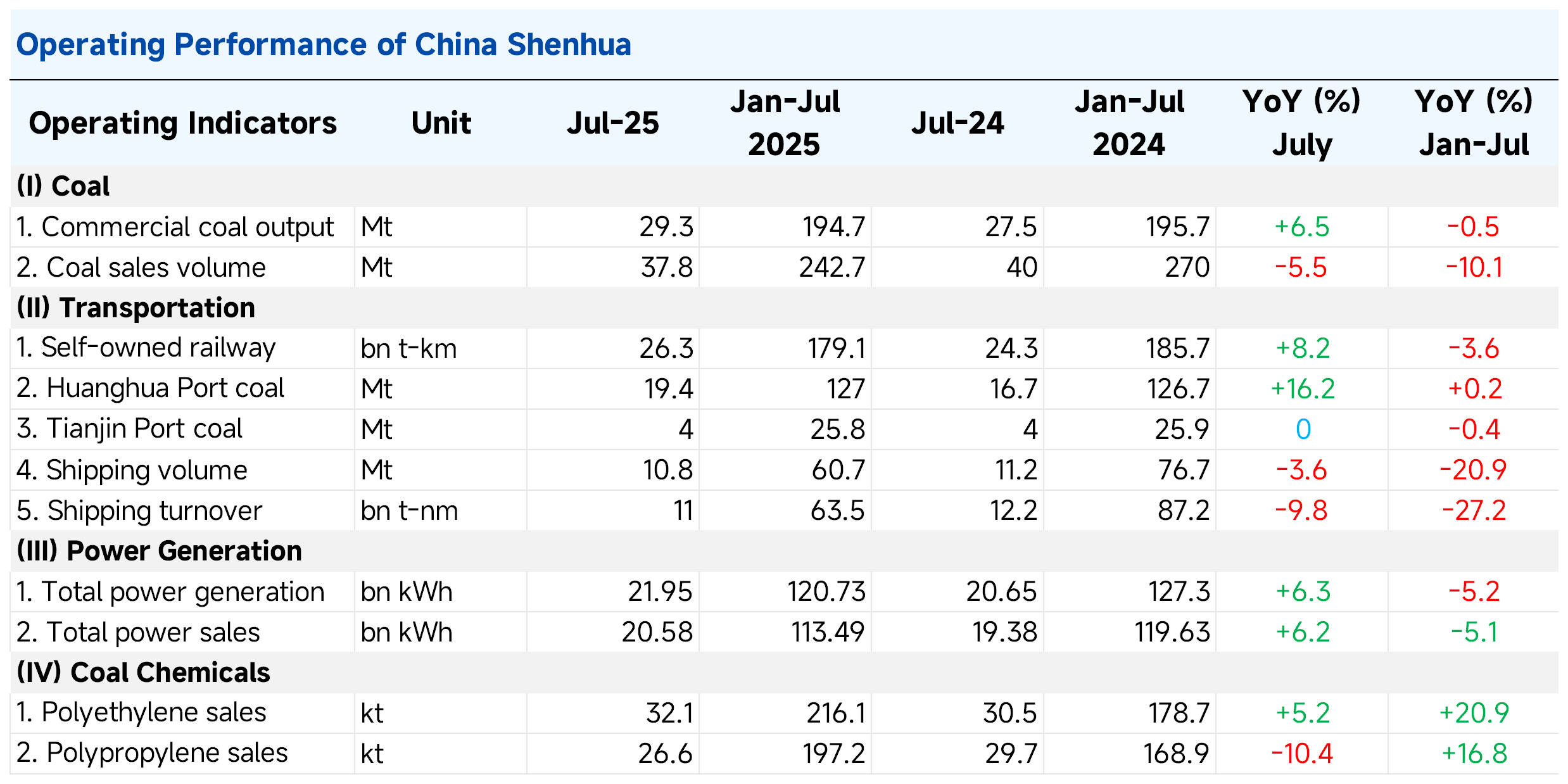

China Shenhua: Output Growth Overshadowed by Sales Decline

In July, China Shenhua produced 29.3 million tonnes of commercial coal, up 6.5% YoY, maintaining solid momentum in production. However, sales fell to 37.8 million tonnes, down 5.5%, reflecting soft downstream demand or structural market shifts.

Transportation performance was strong. Self-owned railway turnover reached 26.3 billion tonne-kilometers (+8.2% YoY), and Huanghua Port shipments totaled 19.4 million tonnes (+16.2%).

In power generation, total output in July was 21.58 billion kWh (+6.3% YoY), with power sales of 20.58 billion kWh (+6.2%). While these segments provide steady cash flow under the company’s integrated coal-power model, growing coal price volatility and a downward market price trend mean they cannot fully offset the pressure from weaker sales.

Yankuang Energy: Volume Gains Fail to Offset Sharp Price Drop

Yankuang Energy’s August 13 H1 2025 earnings preview estimates net profit attributable to shareholders at RMB 4.65 billion, down 38% YoY (a decrease of RMB 2.9 billion). This trend was already visible in Q1, when net profit fell to RMB 2.71 billion, down 27.89% YoY.

The company attributed the decline mainly to lower coal prices—Q1 average sales price fell to RMB 551.20/t from RMB 727.07/t a year earlier. Yankuang attempted to “offset price declines with volume,” lifting Q1 commercial coal output to 36.8 Mt (+6.26% YoY), but coal business revenue still fell by RMB 7.532 billion YoY, exceeding the chemical segment’s total revenue for the same period.

The coal chemical business was a relative bright spot, with Q1 chemical output of 2.414 Mt (+11.59%) and sales of 2.018 Mt (+7.27%), generating RMB 6.299 billion in revenue, roughly flat YoY. The company acknowledged its “synergistic profit” effect, but the scale remains insufficient to fully offset coal segment losses.

Conclusion

Even with July’s modest coal price recovery, both companies’ results highlight the persistence of price weakness. Coal production remains strong, but sales and profit margins face continued pressure. China Shenhua benefits from its transport and power operations, while Yankuang leverages output growth and chemical diversification. Still, in a market with a loose supply-demand balance, the recent price uptick is unlikely to fundamentally change the near-term outlook.