Edited and Updated by Ethan Ma

July 29, 2025

Overall: Frequent Macroeconomic Boosts, Port Quotations Remain Firm

Port-side Thermal Coal:

Port coal prices continued to rise this week. Due to recent rainfall, extreme heat across the country has eased somewhat. Most power plants still have a high number of available coal days, and with strong support from long-term contract coal, their restocking pressure remains low. As a result, the coal price rally slowed slightly at the beginning of the week.

However, after the National Energy Administration announced plans to inspect coal mine overproduction, market bullish sentiment picked up again. Coal prices in major producing regions rose more sharply, supporting firm quotations from port traders.

As of July 25, the CCTD Bohai Ports Spot Price (Daily) was:

5500 kcal: ¥650/ton (+¥11 WoW)

5000 kcal: ¥585/ton (+¥10 WoW)

4500 kcal: ¥520/ton (+¥11 WoW)

CCTD China Coal Market Network is one of the most trusted coal industry think tanks in China, providing exclusive and extensive data coverage.

End-user Demand:

On July 23, 2025, coal consumption across the eight coastal provinces totaled 2.19 million tons,

Down 230,000 tons or 9.5% WoW

Up 360,000 tons or 19.8% MoM

Up 50,000 tons or 2.3% YoY

Total inventory stood at 35.32 million tons,

Up 300,000 tons WoW

Up 320,000 tons MoM

Down 20,000 tons YoY

Weather:

In recent days, southeastern coastal areas have seen heavy rainfall, while southern parts of the Huanghuai and Jianghuai regions experienced sustained high temperatures.

In the coming days, North China, Northeast, and East China will see frequent rainfall, while Huanghuai and Jianghan will continue to face high temperatures.

Cumulative rainfall over the next few days is expected to reach:

60–100 mm in northern North China, central Northeast, eastern and southern Jiangnan, most of South China, northern Shaanxi, western Sichuan, Yunnan, and southeastern Tibet

150–180 mm in parts of these areas, and over 200 mm in some southeastern coastal regions

These rainfall levels are 40–80% above normal, and more than double in certain localities. In contrast, much of the rest of China will receive less precipitation than average.

Freight Rates:

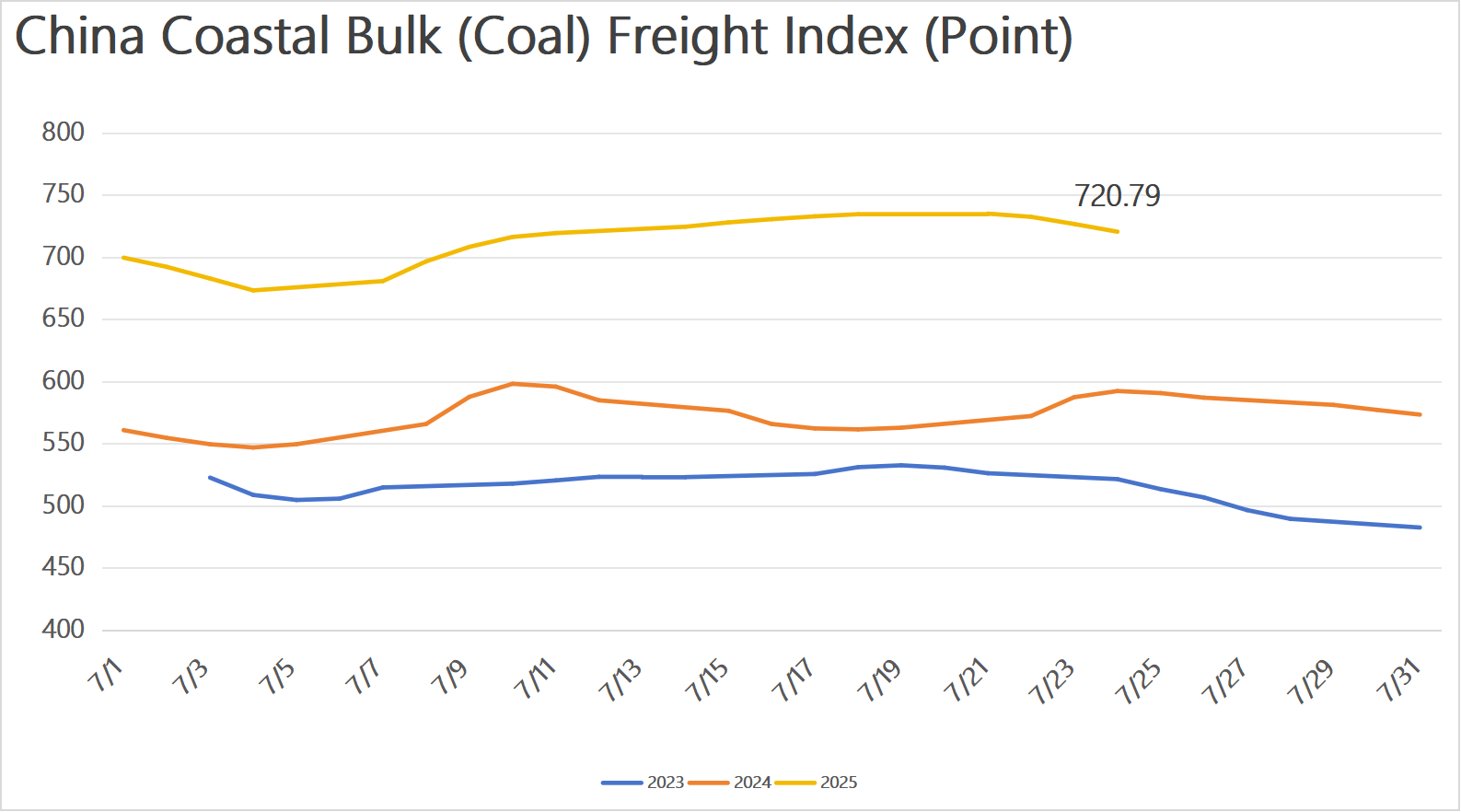

Coastal coal freight rates were weakly stable this week.

With heat easing in coastal provinces and power plants holding high inventory levels, there is little urgency for restocking. After several consecutive coal price hikes, market resistance has grown, reducing overall trading activity. Meanwhile, available shipping capacity remains sufficient, keeping freight rates relatively steady.

As of July 24, the China Coastal Bulk (Coal) Freight Index was 720.8 points, down 12.4 points from July 17.

Qinhuangdao → Guangzhou (50–60k DWT): ¥42.0/ton (↓¥0.2 WoW)

Qinhuangdao → Shanghai (40–50k DWT): ¥27.9/ton (↓¥0.9 WoW)

Inventory:

Inventory at northern ports saw slight fluctuations.

Some major production regions continued to experience heavy rainfall, slowing recovery in coal output. Meanwhile, due to delivery cost inversion, inbound shipments to ports hovered at a moderate level.

On the demand side, end-user inventories remain at relatively safe levels, and the price increase of imported coal is smaller than that of domestic coal. As a result, procurement from northern ports slowed temporarily.

Outbound shipments at ports fell to a mid-range level, slightly below inbound volumes, causing a modest accumulation of port inventory.

| Index | RMB/t | DoD | Basis | Date |

|---|---|---|---|---|

| Datong 5500 | ex-mine | 07-01 | ||

| Shuozhou 5200 | FOR | 07-01 | ||

| Ordos 5500 | ex-mine | 07-01 | ||

| Yulin 6200 | ex-mine | 07-01 | ||

| Liulin Low-sulphur | ex-mine | 07-01 | ||

| Gujiao Low-sulphur | FOR | 07-01 | ||

| Xingtai Low-sulphur | ex-Factory | 07-01 | ||

| Yangquan PCI | FOR | 07-01 |

| Index | RMB/t | WoW | WoW% | Date |

|---|---|---|---|---|