[Market Trends]

1. Thermal Coal

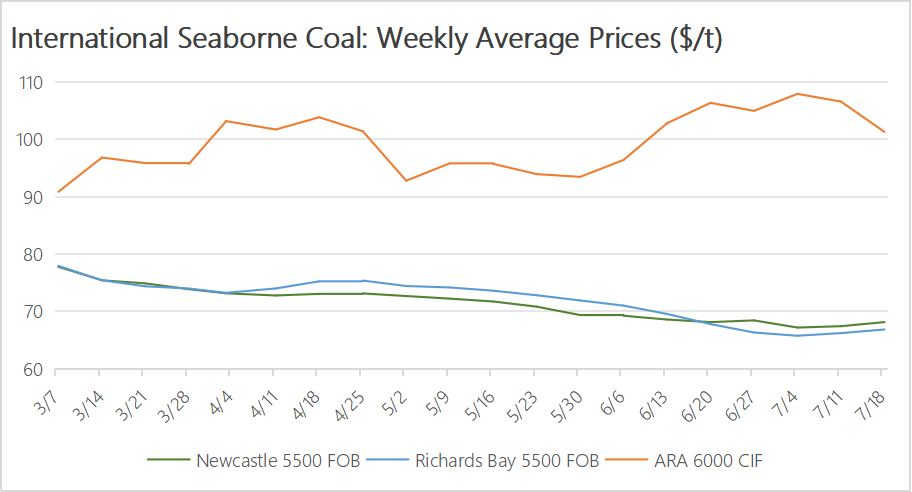

This week, supply-demand dynamics varied across global thermal coal markets. The Australian coal market remained upbeat, pushing Newcastle Port prices higher. Tight supply and rising demand drove up prices at Richards Bay. In contrast, falling natural gas prices in Europe led to a continued decline in coal prices at the European ARA ports.

Weekly average coal prices as of the week ending July 18:

Newcastle 5500 FOB: $68.1/ton, up $0.71 (+1.05%)

Richards Bay 5500 FOB: $66.81/ton, up $0.63 (+0.95%)

ARA 6000 CIF: $101.3/ton, down $5.29 (−4.96%)

CCTD China Coal Market Network is one of the most trusted coal industry think tanks in China, providing exclusive and extensive data coverage.

Asia-Pacific:

Australian coal prices rose further aligning with domestic market. Vessel delays at Newcastle continued.

Hot weather across China lifted daily coal burn at power plants, accelerating inventory drawdowns. Domestic supply was also limited by rain-affected mining areas, supporting stronger local prices. Imported mid- to low-cal coal remained cost-competitive, prompting increased spot buying by utilities. However, with rising freight costs, traders remained cautious. Future trends depend on plant consumption and freight rates.

In India, spot demand stayed weak due to monsoon season, high port stockpiles, and subdued industrial and power usage—limiting further upside for seaborne coal.

Atlantic:

European coal prices declined further this week amid a sharp drop in natural gas prices. South Africa’s rail shutdown (10–12 days) supported price levels, while slight demand recovery from India’s sponge iron sector helped push Richards Bay prices higher.

2. Coking Coal

The international coking coal market remained subdued this week. Australian FOB prices continued to decline, while China’s CFR import prices kept climbing. Domestically, Chinese coking coal prices surged further amid tight supply and active restocking demand.

For domestic market (China), production constraints at key mines (due to underground conditions) limited supply recovery. Strong procurement by coke producers and speculative buyers led to high sales and rapid inventory drawdown.

With tight supply of certain coking coal types, hot metal (liquid iron) output rebounding and raw material costs soaring, coke prices are expected to rise again, supporting firm coal prices in the short term.

During the Naadam Festival (July 11–15), the three major China-Mongolia border crossings were closed for five days and reopened on July 16. Since then, cross-border volumes have gradually recovered. The Mongolian coal market remained firm this week. During the closure period, inventories in the customs supervision zones declined significantly, and available spot supply at the border tightened further. Traders held firm on offer prices, and with futures prices strengthening again, Mongolian coal prices rose once more.

On the international front, seasonal factors led to a demand slowdown. Many regions in Europe entered maintenance shutdowns, reducing coking coal consumption. In India, the onset of the monsoon season caused a noticeable deceleration in procurement, and buyers showed significantly weaker interest in premium coking coal.

Key Price Data (Week Ending July 18):

Australian premium low-vol HCC FOB:

$172/ton, ↓ $5.5 (−3.1%)

(Spec: S 0.5%, Ash 9.3%, VM 21.5%, Moisture 9.7%, CSR 71%)

China CFR price for the same coal:

$163/ton, ↑ $3 (+1.88%)

[Statistics]

According to statistics released by the Bureau of Customs under the Philippine Department of Finance, the Philippines imported a total of 19.299 million tons of coal from January to June 2025, down 1.5% compared to the same period last year. In June alone, coal imports reached 3.344 million tons, marking a year-on-year decrease of 3.7% and a month-on-month decline of 8.0%.

[Events]

Indonesia Considers Imposing Coal Export Tax

According to foreign media reports, the Indonesian government is considering imposing a tax on coal exports to boost fiscal revenue. Authorities are still in the process of determining the specific tax rate.

“If coal prices are reasonable, miners should share part of their profits with the government. But if prices are low, the government will not impose additional burdens on companies,” said Minister Bahlil.

The Indonesian government has been rolling out various revenue-enhancing measures to support its large-scale spending programs, which include providing free meals for all students and building public housing. Earlier this year, nickel, tin, and other mineral producers in Indonesia began paying mining rights taxes.

The mining rights tax from the coal industry already represents a major source of non-tax government revenue. The proposed export tax would further increase the overall tax burden on coal producers.

According to government data, Indonesia’s coal production reached 834 million tons in 2024, with about half of the output destined for export.

| Index | RMB/t | DoD | Basis | Date |

|---|---|---|---|---|

| Datong 5500 | ex-mine | 07-01 | ||

| Shuozhou 5200 | FOR | 07-01 | ||

| Ordos 5500 | ex-mine | 07-01 | ||

| Yulin 6200 | ex-mine | 07-01 | ||

| Liulin Low-sulphur | ex-mine | 07-01 | ||

| Gujiao Low-sulphur | FOR | 07-01 | ||

| Xingtai Low-sulphur | ex-Factory | 07-01 | ||

| Yangquan PCI | FOR | 07-01 |

| Index | RMB/t | WoW | WoW% | Date |

|---|---|---|---|---|