By Joy

July 18, 2025

Edited and Updated by Ethan Ma

July 18, 2025

Recently, driven by rising transportation costs and strong seasonal consumption expectations, sellers have maintained firm price offers.

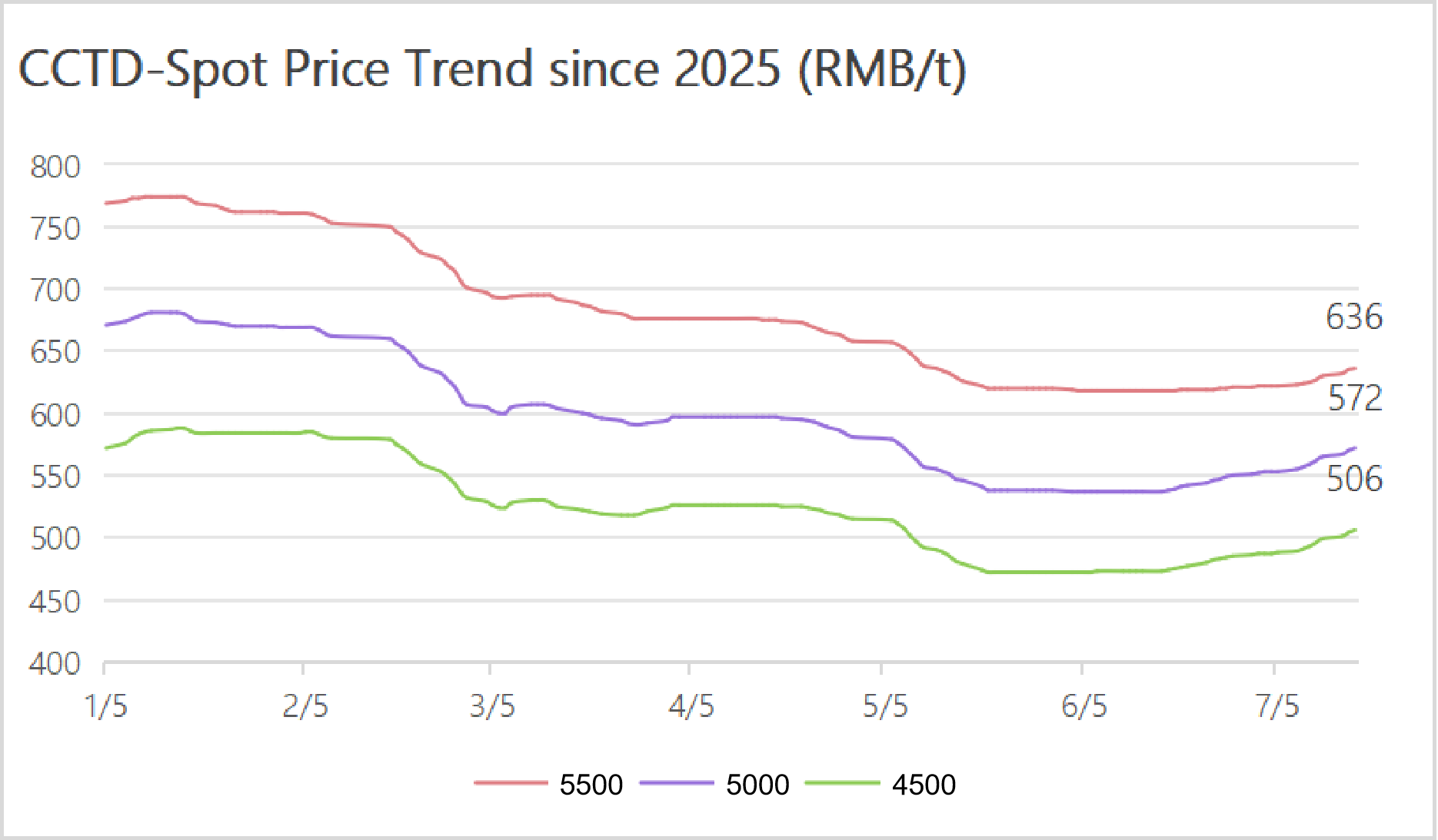

As of July 17, “CCTD-Spot Price” for 5500K, 5000K, and 4500K stood at 636, 572, and 506 yuan/ton respectively, up 1, 2, and 2 yuan DoD, and 11, 13, and 13 yuan WoW.

What Changes Might Occur in Late July? Can Coal Prices Continue to Climb?

1. Coal Supply from Production Areas Continues to Recover

First, in early July, although environmental and safety inspections had less impact on production than before, frequent rainfall in key mining areas restricted open-pit coal mining, tightening supply in some regions. Since mid-July, clearer weather has allowed coal production to gradually recover. According to China’s National Meteorological Center, rainfall in late July will mainly occur in the southern and southeastern regions, while key coal-producing provinces like Shanxi, Shaanxi, and Inner Mongolia will see fewer rain events—conducive to normal mine operations.

Second, due to low output in Shaanxi and Inner Mongolia earlier this month, fewer mines are expected to suspend operations at the end of July compared with previous months.

Third, at the end of June, Shaanxi Energy Bureau convened a provincial coal production meeting, calling for coordinated development and safety efforts to stabilize and increase output.

2. Solid Hauling Demand from End-Users

According to the National Meteorological Center, starting from July 21, the intense heat will ease significantly, with scattered high temperatures of 35–37°C expected in southern Hebei, southern Huanghuai, Jianghuai, central Jiangnan, and the Guanzhong region of Shaanxi. This means the upward momentum of daily coal burn at power plants may weaken slightly. However, given the ongoing "Sanfu" heatwave—especially the hottest period from July 30 to August 8—power plant procurement is still expected to remain strong, with high contract fulfillment rates likely to persist.

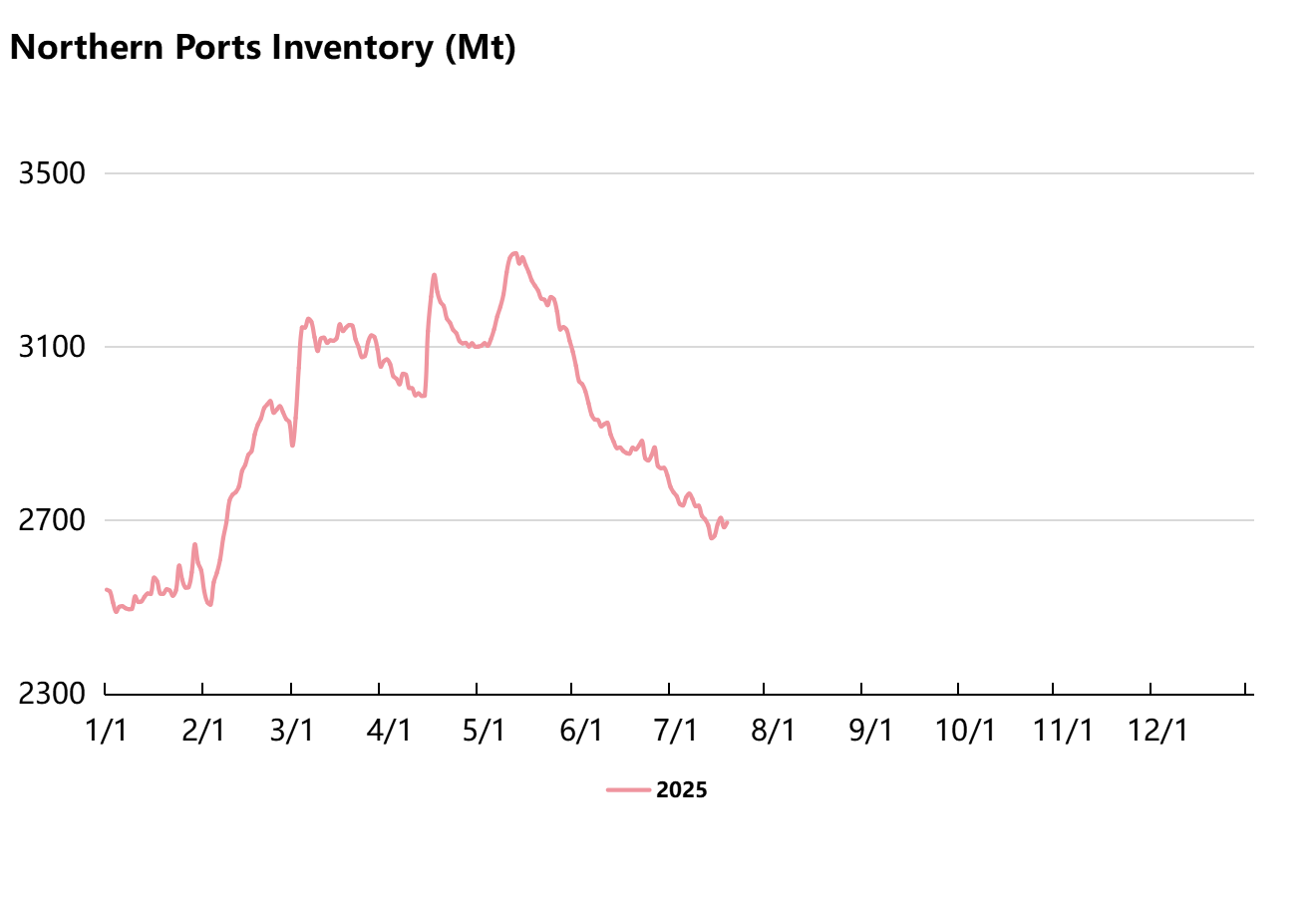

3. Slower Inventory Drawdown at Northern Ports

Inventories at northern ports have been steadily declining. CCTD data shows that combined coal stocks at nine northern ports have dropped below 27 million tons, down more than 6 million tons from earlier peaks, and only up 4% year-on-year. In the short term, as peak summer demand continues, outbound shipments from northern ports will stay elevated. With mine production resuming, coal deliveries to the ports are also expected to increase. In addition, a stronger bullish sentiment at the ports is likely to stimulate more hauling from traders, pushing up inbound volumes. Overall, both inbound and outbound flows may increase in late July, slowing down the pace of inventory drawdown.

Conclusion

Although inventory drawdown at northern ports may slow in late July, the shortage of in-demand coal will remain unresolved, and traders are likely to continue withholding supply. At the same time, demand from end-users will remain strong during the peak "Sanfu" season, supporting prices. However, as production recovery continues, upward pressure on coal prices will increase. All factors considered, thermal coal prices are expected to maintain an upward trend through the end of July.

| Index | RMB/t | DoD | Basis | Date |

|---|---|---|---|---|

| Datong 5500 | ex-mine | 07-01 | ||

| Shuozhou 5200 | FOR | 07-01 | ||

| Ordos 5500 | ex-mine | 07-01 | ||

| Yulin 6200 | ex-mine | 07-01 | ||

| Liulin Low-sulphur | ex-mine | 07-01 | ||

| Gujiao Low-sulphur | FOR | 07-01 | ||

| Xingtai Low-sulphur | ex-Factory | 07-01 | ||

| Yangquan PCI | FOR | 07-01 |

| Index | RMB/t | WoW | WoW% | Date |

|---|---|---|---|---|