By Hongmo

July 16, 2025

Edited and Updated by Ethan Ma

July 16, 2025

Since early July, high temperatures have intensified across China, driving steady increases in thermal coal demand. Meanwhile, supply continues to fall short of expectations. As a result, the thermal coal market has tilted further in favor of sellers, supporting a continued price rebound.

As of July 16, the CCTD-Spot Index recorded:

5,500 kcal/kg: 635 RMB/ton

5,000 kcal/kg: 570 RMB/ton

4,500 kcal/kg: 504 RMB/ton

CCTD China Coal Market Network is one of the most trusted coal industry think tanks in China, providing exclusive and extensive data coverage.

On a daily basis, all three grades rose by 3 RMB/ton; on a weekly basis, they increased by 14, 19, and 18 RMB/ton respectively.

Supply-Side Constraints Easing Slowly

Notable Decline in Coal Imports

Imported coal volumes have continued to fall since June due to weakened price competitiveness. According to the General Administration of Customs, China imported 33.037 million tons of coal in June, down 8.3% MoM and 25.9% YoY. For the first half of 2025, total imports stood at 221.702 million tons, a YoY decrease of 11.1%.

Weather-Disrupted Domestic Production

Persistent rainfall has significantly affected production, especially at open-pit mines in major producing regions. As a result, pithead inventories have declined, and miners are showing stronger price-holding sentiment.

Falling Port Inventories

Coal supply to ports has remained weak due to reduced mine output and unprofitable transport margins. Since July, daily volumes on the Daqin Railway have often dropped below 1 million tons. Port stocks have followed a downward trend. According to CCTD data, northern ports currently hold 26.85 million tons, down 714,000 tons from the start of the month. Compared to last year, inventories have fallen from a previously high level to slightly above the same period last year.

Demand-Side Strengthens Further

Power demand has surged this summer, with national peak loads hitting historic highs twice. In 10 provincial-level power grids—including Shandong, Jiangsu, Anhui, and Fujian—daily load records have been broken 22 times. With electricity consumption climbing, daily thermal coal burn has risen steadily, pushing up rigid procurement from power plants.

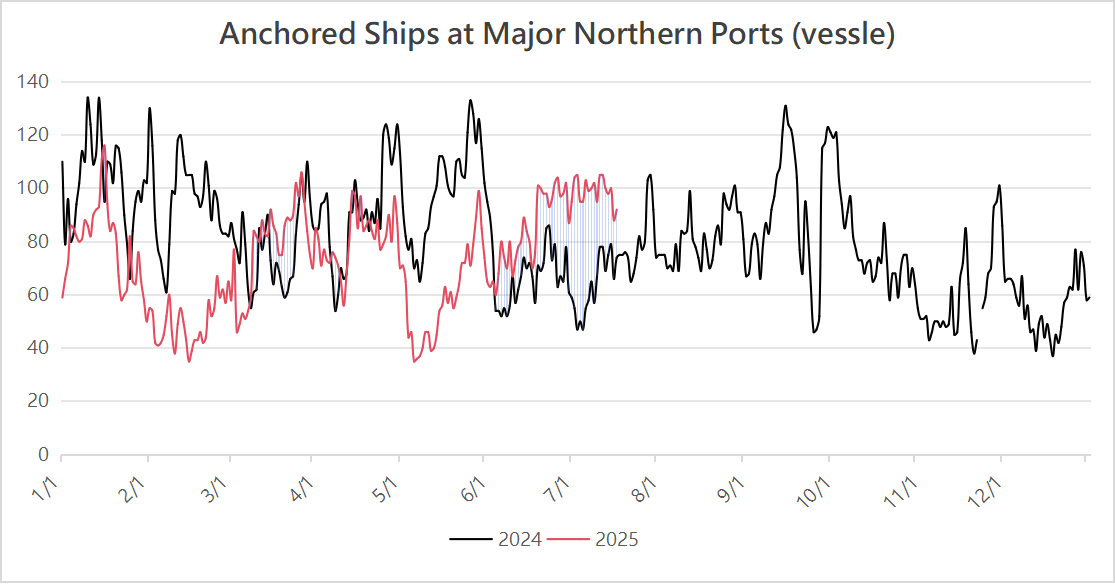

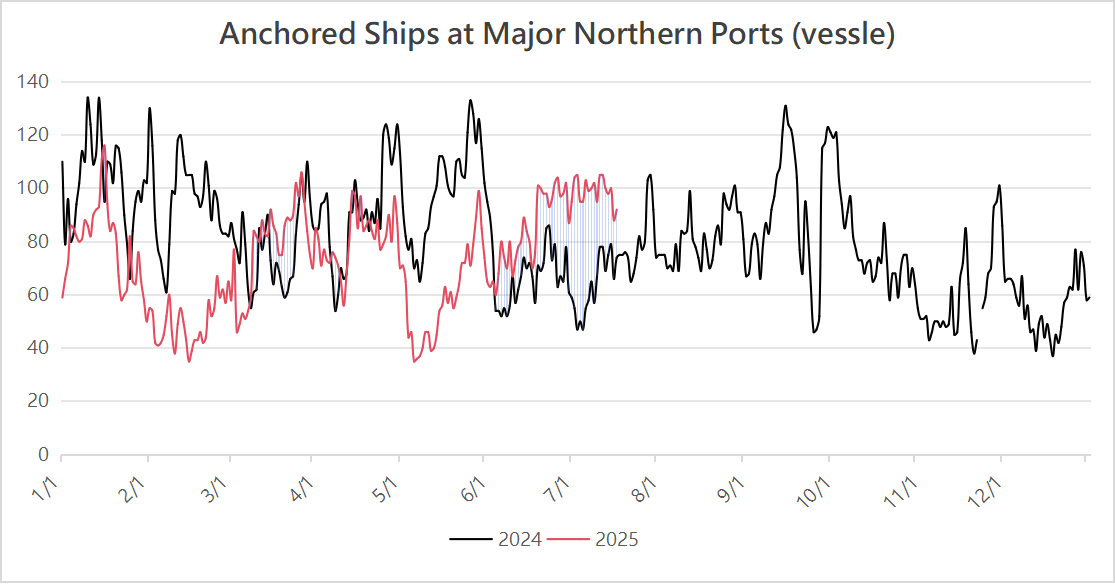

CCTD data also shows that since July, the average number of vessels anchored daily at major northern ports has reached 100 ships, the highest level this year—up 37 ships YoY. Additionally, as market sentiment improves, traders and logistics players are becoming more active in restocking.

Outlook: Gradual Tightening and Upward Momentum

The impact of the summer peak has clearly emerged. The fundamentals of the thermal coal market are shifting from oversupply toward a mildly loose balance. Combined with improving macroeconomic sentiment and a broad-based rebound in commodity markets, thermal coal prices are expected to continue their upward correction in the near term.