By Chengfang

July 15, 2025

Edited and Updated by Ethan Ma

July 16, 2025

In Brief:

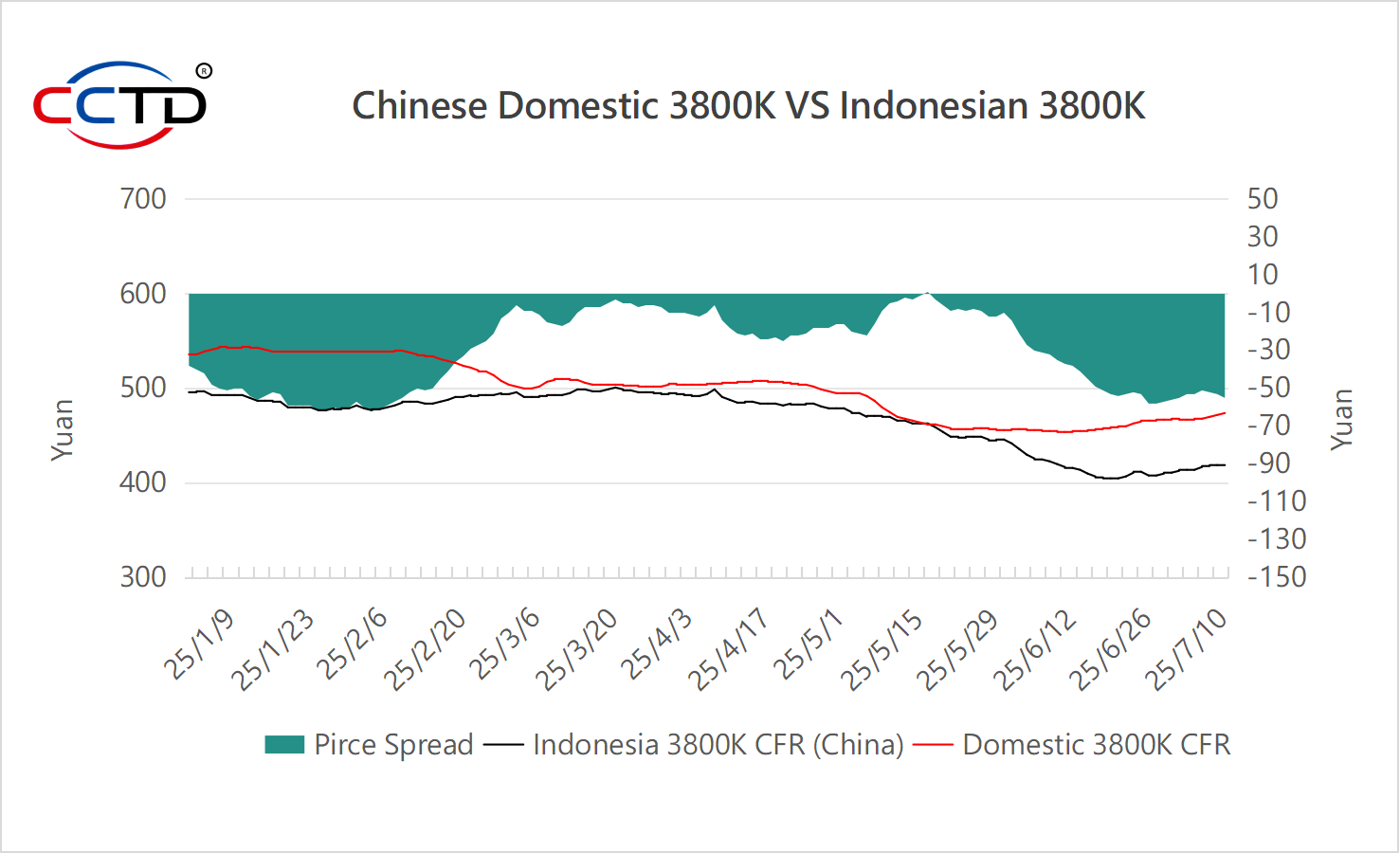

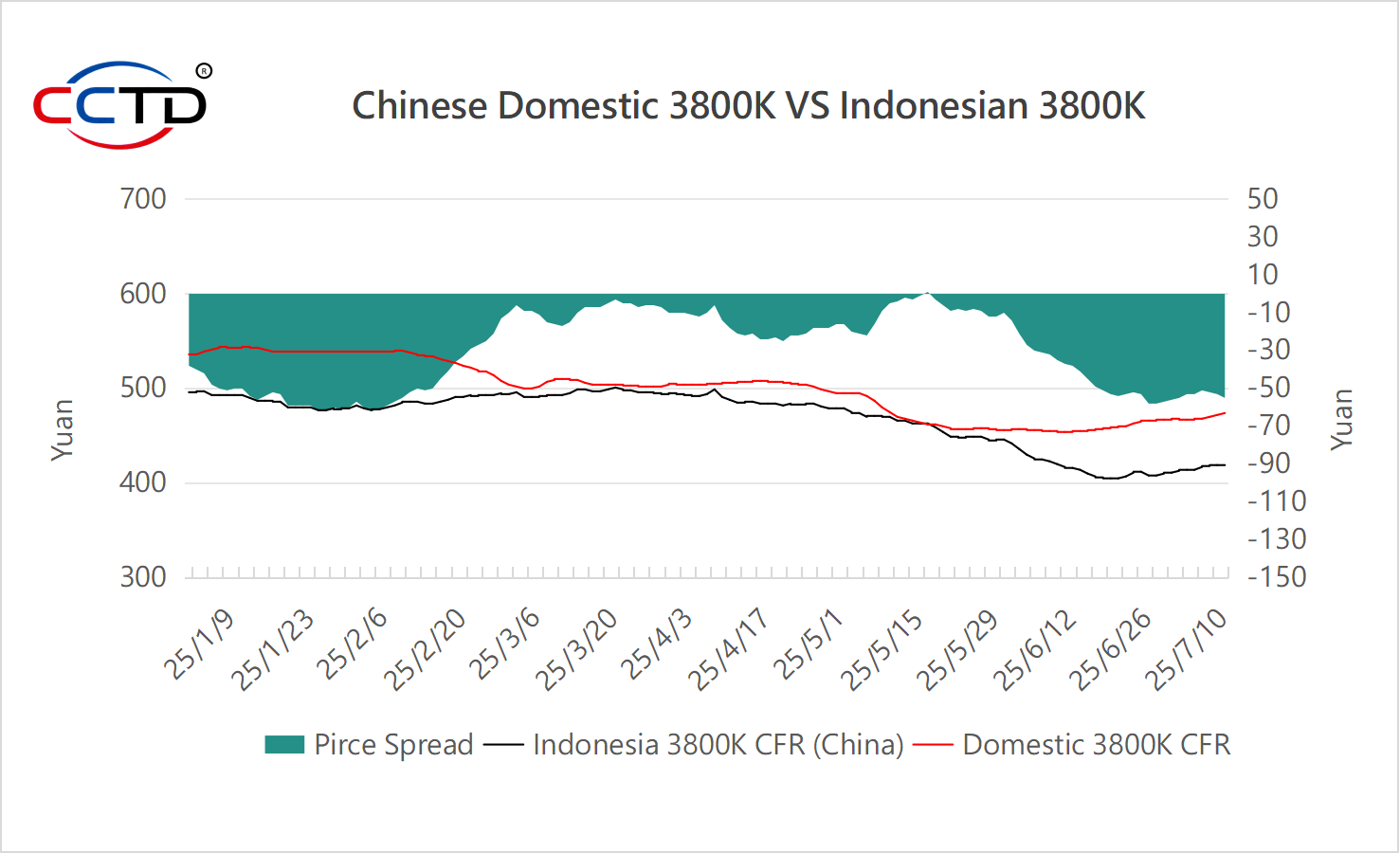

·Indonesian coal regains price edge, 3800K cheaper by over RMB 40/ton.

·Power plants remain cautious, deal volumes stay low.

·Weak Indian demand adds pressure on Indonesian coal prices.

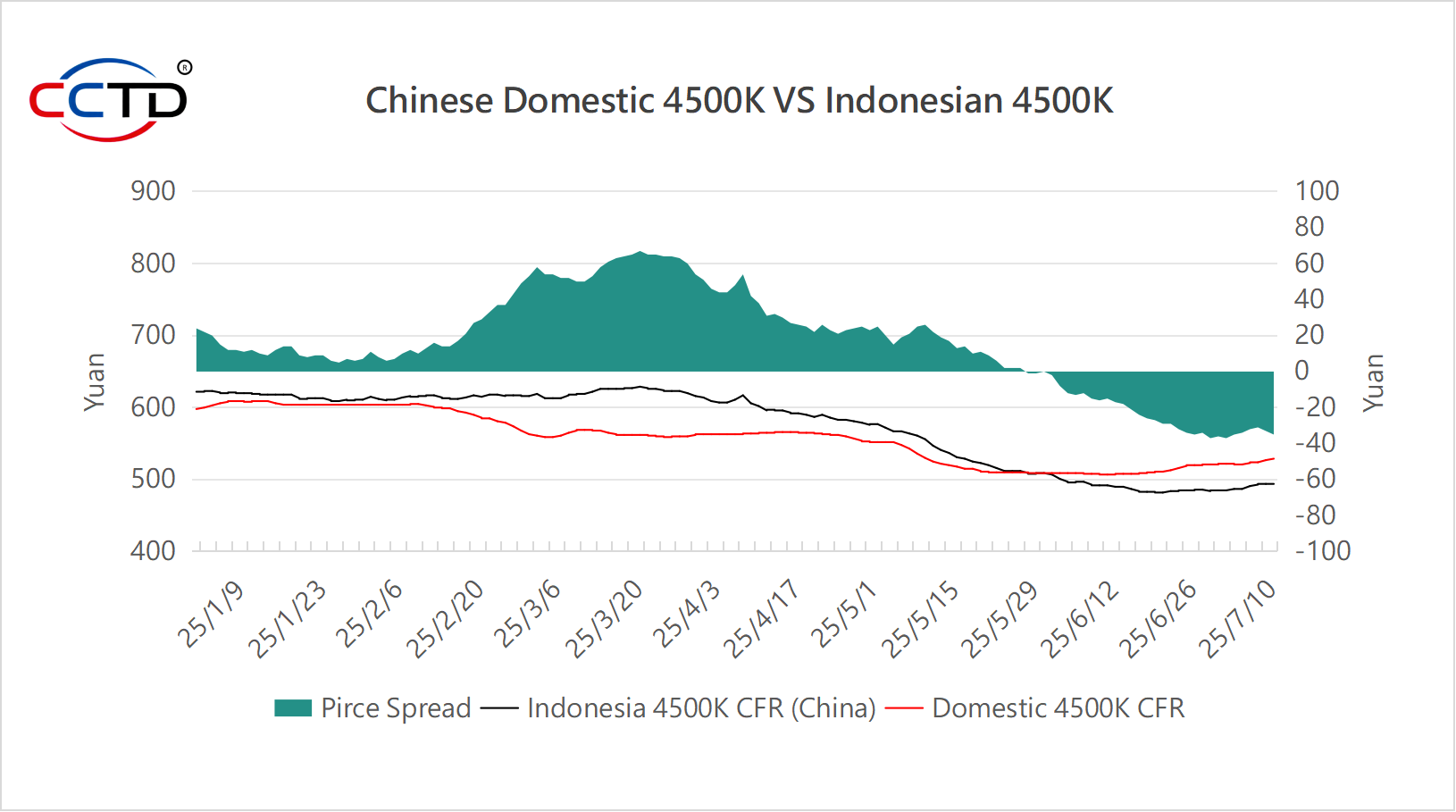

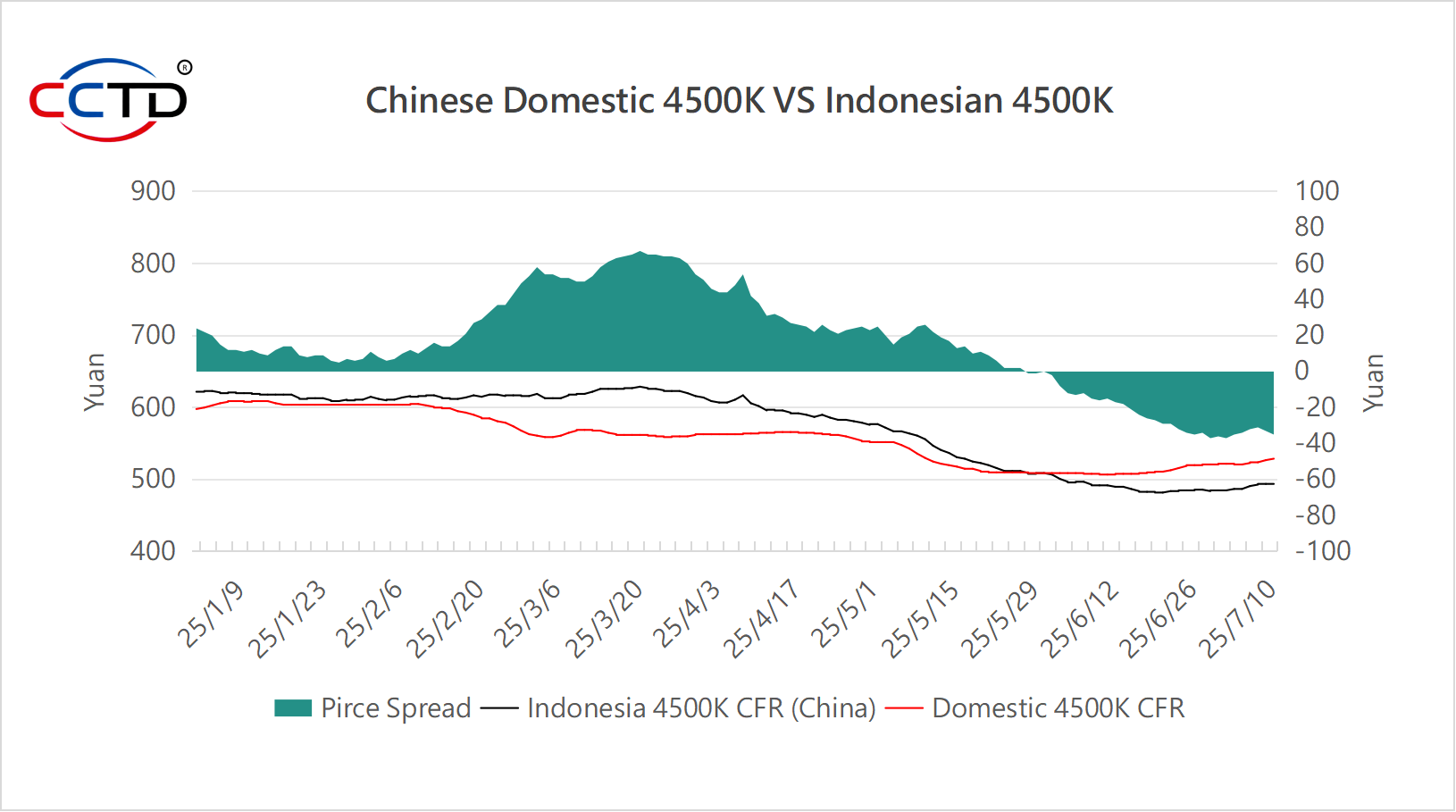

Since June, as China’s domestic coal market has gradually stabilized and prices have edged up, seaborne coal prices have continued to decline. The price gap between imported and domestic coal has narrowed, once again highlighting the price advantage of imported coal. The CFR price of Indonesian 4500K thermal coal, which had been higher than domestic equivalents since the beginning of the year, has now dropped below domestic prices. Meanwhile, the price advantage of Indonesian 3800K coal has expanded to over RMB 40/ton compared to domestic equivalents.

Driven by this shift, there has been a slight increase in inquiries from end-users in the import market, particularly for lower-CV coal, which has helped lift seaborne quotations slightly. However, Chinese power plants remain cautious, with limited willingness to accept higher prices. Aggressive price bargaining has led to limited actual transactions.

CCTD China Coal Market Network is one of the most trusted coal industry think tanks in China, providing exclusive and extensive data coverage.

In July, with temperatures rising rapidly across China, daily thermal coal consumption has increased, and power plants have become more active in issuing tenders. Although inventories remain relatively high and end-user demand has yet to rebound strongly, the notable price advantage of imported coal has encouraged domestic power companies to release new bids.

However, Indonesia’s second-largest coal buyer—India—is facing sluggish demand due to an early-arriving monsoon season. Both port and power plant stockpiles in India are at multi-year highs, suppressing coal consumption. At the same time, weak demand from Chinese end-users and increasing domestic coal supply are also weighing on imports.

From a supply perspective, with Indonesia entering the dry season, the impact of rainfall on coal output is minimal, and export volumes are likely to remain stable or slightly increase.

Looking ahead, China’s steadily rising domestic supply, coupled with strong performance in long-term contract fulfillment this year, has reduced reliance on imported coal. Domestic buyers remain price-sensitive, often pressing for lower prices, and some tenders have failed due to uncompetitive bids. On the other hand, India’s subdued demand during the monsoon season is also dampening Indonesian coal prices.

As a result, Indonesian suppliers may lack the momentum to maintain firm prices, and further price reductions are still possible. In the short term, imported coal is expected to retain its price advantage over domestic coal.