Edited and Updated by Ethan MaJuly 15, 2025

1.Thermal Coal

Overall:

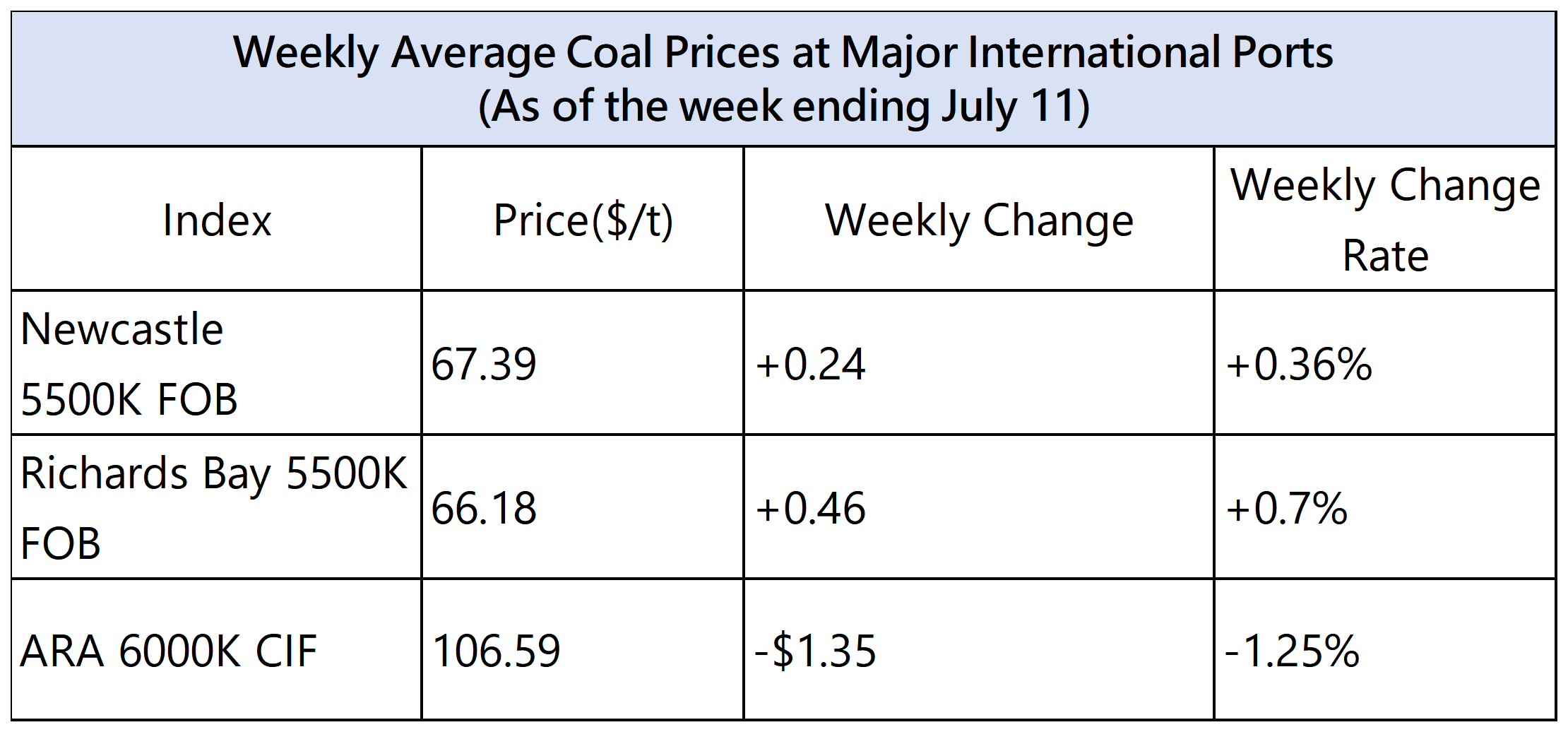

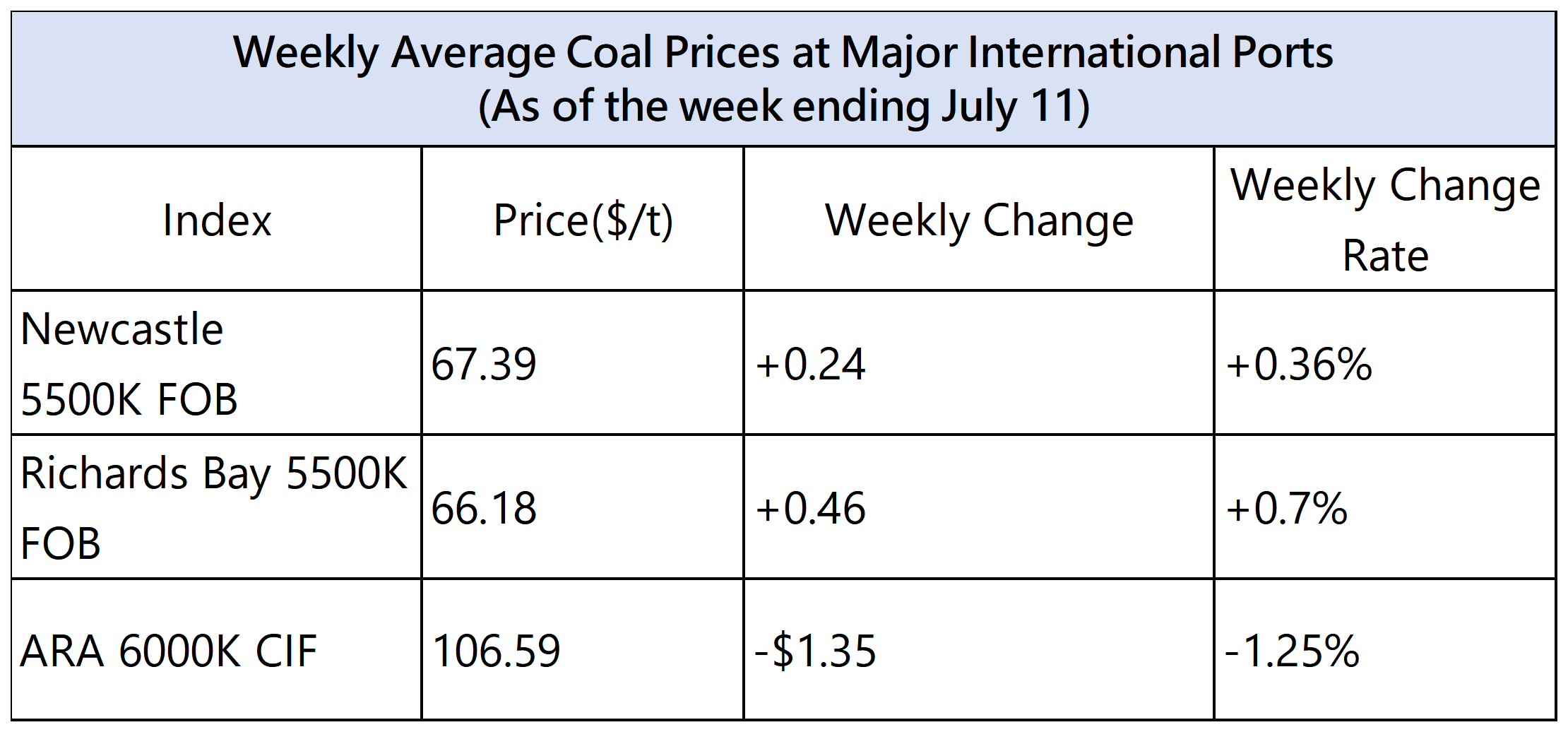

Diverging Supply-Demand Trends in the Global Thermal Coal Market; Weekly Average Prices Show Mixed Movements Compared to the Previous Week.

This week, Australian coal supply faced slight disruptions, pushing up the average daily FOB price of Newcastle Port. At Richards Bay, prices rebounded slightly amid expectations of tighter supply. However, weakening coal consumption from end-users caused the average CIF price at European ARA Ports to fall again.

CCTD China Coal Market Network is one of the most trusted coal industry think tanks in China, providing exclusive and extensive data coverage.

Asia-Pacific Region:

This week, although demand from China, Japan, and South Korea for Australian coal remained subdued, weather-related logistics disruptions pushed Australian coal prices slightly higher. Despite high stock levels and no significant rebound in end-user consumption, Chinese power utilities increased tenders for Indonesian low-calorific coal, benefiting from its continued price advantage over domestic coal.

Strong seasonal demand expectations supported firm miner offers, and recent concentrated procurement by power plants prompted some suppliers to raise prices slightly. However, elevated FOB prices and rising freight rates have pushed up CFR costs, leading some Chinese traders to remain cautious in signing new deals.

Meanwhile, the strong performance of contract coal deliveries this year has somewhat reduced terminal dependence on the spot market. On the other hand, weak demand during India’s monsoon season has put downward pressure on Indonesian coal prices.

Overall, market participants believe a continued price rally for imported coal in the near term is unlikely, with trends depending more on domestic coal market dynamics and actual power demand levels.

Atlantic Region:

This week, thermal coal prices at Europe’s three major ports fell again due to lower natural gas prices and increased renewable energy generation.

Meanwhile, South African miner offers remained firm, as the national rail company plans to conduct a 10–12 day annual maintenance shutdown starting mid-July.

A South African producer noted: “Due to derailments accidents and maintenance, suppliers have become more cautious in sales. This could reduce supply and push prices up. The planned shutdown may further strain already stressed logistics infrastructure, worsening supply constraints.” As a result, South African thermal coal prices ended their decline and edged up slightly.

2. Coking Coal

Global coking coal demand remained weak this week. Australian FOB prices declined again, while China’s CFR prices continued to edge up.

In China, coking coal prices rose across major production areas, with increases ranging from 20 to 80 RMB/ton. Some mines continued to reduce or suspend output due to underground operational issues, slowing overall supply recovery.

Boosted by a sharp rise in steel-related futures, market sentiment turned optimistic. Coke plants actively restocked, and traders increased procurement. Transaction volumes improved, auctions saw higher prices and strong success rates, and mine inventories continued to decline.

For imported Mongolian coking coal, customs clearance volume at the Ganqimaodu border increased this week. Futures-led optimism lifted market sentiment, and trade activity at the border became more active. With the Nadam Fair causing temporary closures at the crossing and tighter supply expectations ahead, Mongolian coal offers continued to rise.

Internationally, coking coal demand stayed sluggish, with ample offers from various countries. Major Australian mines adjusted tender prices downward midweek.

If unexpected events arise in July—such as extreme weather in key producing countries, renewed geopolitical tensions, or sharp freight rate swings—imported seaborne coking coal prices may see short-term volatility. However, without significant fundamental improvement, prices are expected to remain low and rangebound through July.

Australian FOB Prices for HCC Declined Again; China CFR Prices Edged Up

As of the week ending July 11:

The FOB price for Australian low-vol premium HCC (specs: S 0.5%, Ash 9.3%, Vol 21.5%, TM 9.7%, CSR 71%) was $177.5/ton, down $4.5 from the previous week (−2.47%).

The CFR price for the same coal delivered to China was $160/ton, up $1 (+0.63%).