By Hongmo

July 8, 2025

Edited and Updated by Ethan Ma

July 9, 2025

Recently, end-users have maintained rigid demand procurement, but the release of incremental demand remains limited. However, with port inventories continuing to decline and high temperatures intensifying, sellers have shown a strong willingness to hold firm on prices. The market is operating with a steady-to-strong tone.

CCTD China Coal Market Network is one of the most trusted coal industry think tanks in China, providing exclusive and extensive data coverage.

As of July 8, the "CCTD Spot" reported prices of 623, 555, and 489 yuan/ton for 5500K, 5000K, and 4500K, respectively—up 1, 2, and 1 yuan from the previous day, and up 2, 4, and 3 yuan week-on-week.

Looking into mid-July, the supply-demand balance in the thermal coal market is expected to continue improving, with further room for price increases.

Production May Fall Short of Expectations

From January to May, national raw coal output reached 1.985 billion tons, up 6.0% year-on-year. In June, however, production slowed due to environmental inspections, safety regulations, and rising production costs. Entering July, persistent heavy rainfall has further suppressed output. The latest CCTD monitoring shows that the capacity utilization rate of sample coal mines in Shanxi, Shaanxi, and Inner Mongolia dropped to 80.4%, down both month-on-month and year-on-year.

Port Inventories Continue to Decline

With increasing temperatures, coastal power plants have ramped up coal consumption, and rigid demand procurement has steadily increased. According to CCTD data, the number of vessels anchored at major Bohai-Rim ports has stabilized around 100—a yearly high and significantly higher than the same period last year. Driven by demand, port inventories have continued to decline. As of July 7, coal inventory at Qinhuangdao Port dropped to 5.76 million tons, 190,000 tons lower year-on-year and down 1.85 million tons from the annual high, a 24.3% decrease.

Sellers Hold Firm on Prices

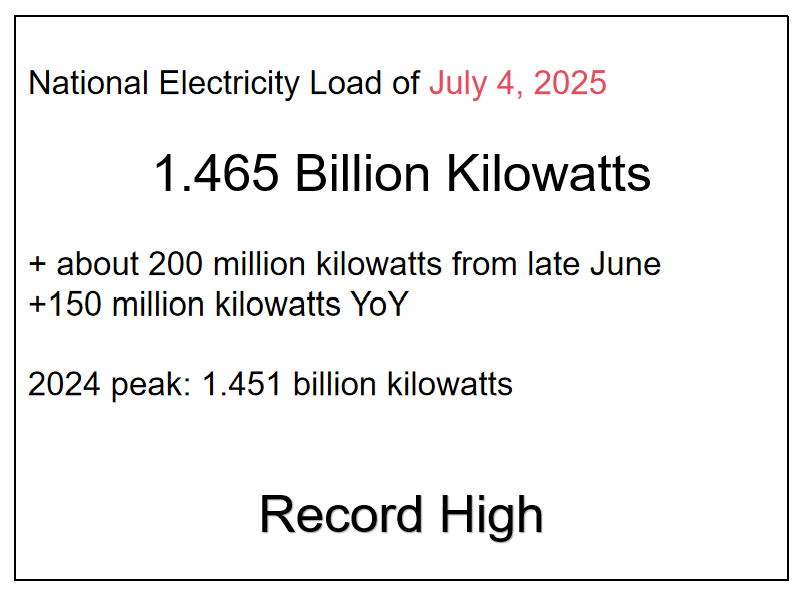

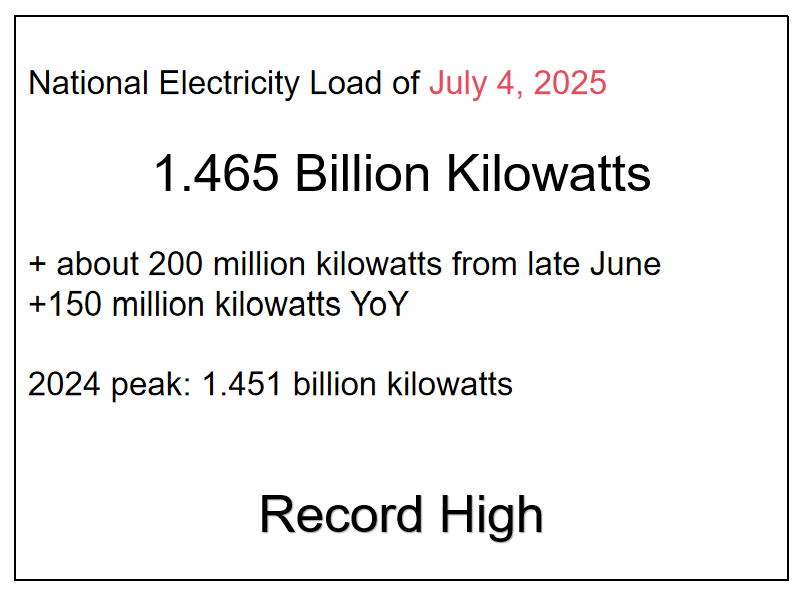

Coal supply from production areas remains below expectations, and mine-mouth prices are relatively firm. High procurement costs in the circulation segment have made replenishment difficult after sales. Seasonal demand continues to support market sentiment. On July 4, China’s national power load hit a record 1.465 billion kilowatts, up about 200 million kilowatts from late June, surpassing the 2024 peak (1.451 billion kilowatts) and rising nearly 150 million kilowatts year-on-year. With power demand surging, sellers remain optimistic about this summer’s market performance.

Conclusion

With the arrival of the "Lesser Heat" jieqi (Chinese traditional solar term), electricity demand is expected to rise further, driving up daily thermal coal consumption. As a result, procurement demand will likely continue to grow. Meanwhile, due to frequent rainfall and a high production base, there is limited room for a significant supply increase. Therefore, social inventory of thermal coal is expected to continue declining, providing ongoing support for prices to trend upward.