China Northern Ports Coal Inventory Falls for 8 Straight Weeks!

Time:2025-07-08 09:54:50 Source:CCTD

By Joey

July 7, 2025

Edited and Updated by Ethan Ma

July 8, 2025

Recently, coal inventories at northern ports have continued to decline, while structural shortages in supply persist, supporting a steady to slightly bullish pricing environment for sellers.

As of July 7, the CCTD Spot recorded prices for 5500K, 5000K, and 4500K coal at RMB 622, 553, and 488/ton, respectively, with day-on-day changes of 0, 0, and +1 RMB/ton.

With peak summer demand approaching, power plant coal consumption is expected to rise — but can coal prices maintain their upward trend?

1. Coal Supply Recovery at the Mine Mouth Remains Slow

In July, safety and environmental pressures on coal mines have eased, and supply is expected to increase compared to June. However, local meteorological data show frequent rainfall in producing regions, with heavy rain in some areas temporarily disrupting production and sales. A small number of mines remain closed due to safety or environmental concerns. Thus, supply recovery in early July may be slower than expected. By mid-July, once adverse factors subside, production should return to normal levels.

2. High Terminal Haulage Demand Continues

With rising temperatures, residential cooling demand is increasing, boosting restocking needs for power plants. According to CCTD China Coal Market Network, around 100 vessels are currently anchored at northern ports — a higher count than the same period last year. In the short term, end-user coal haulage is expected to remain high.

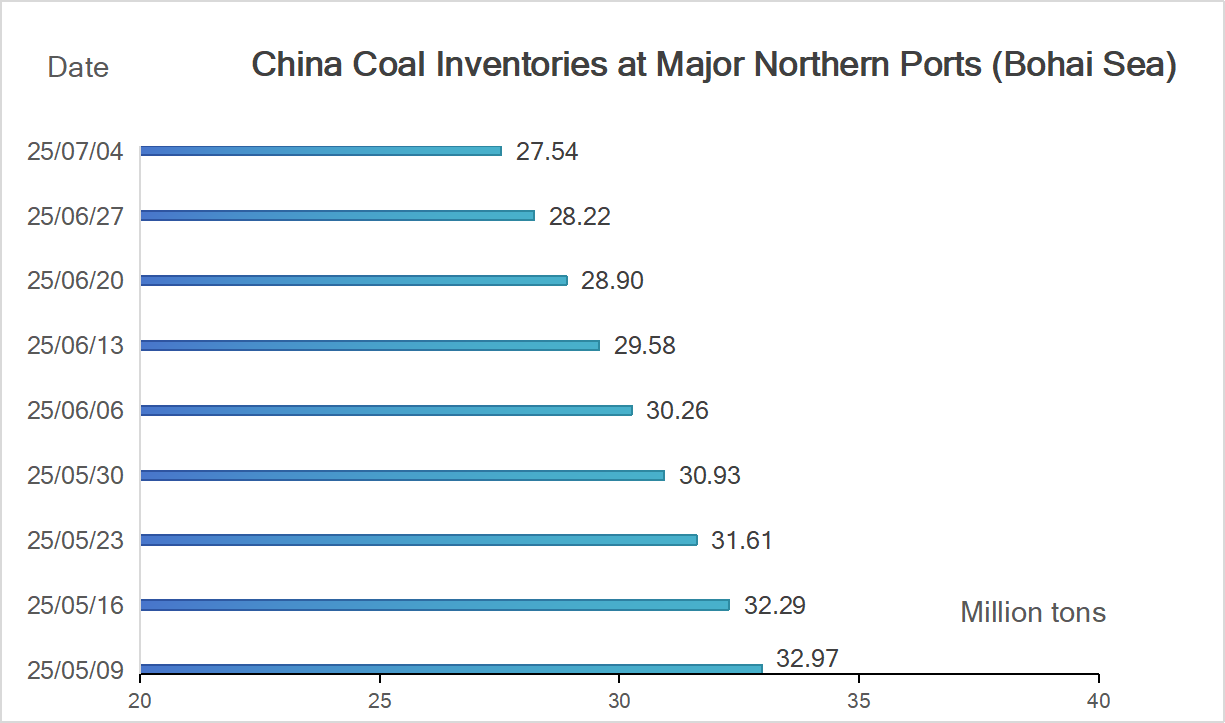

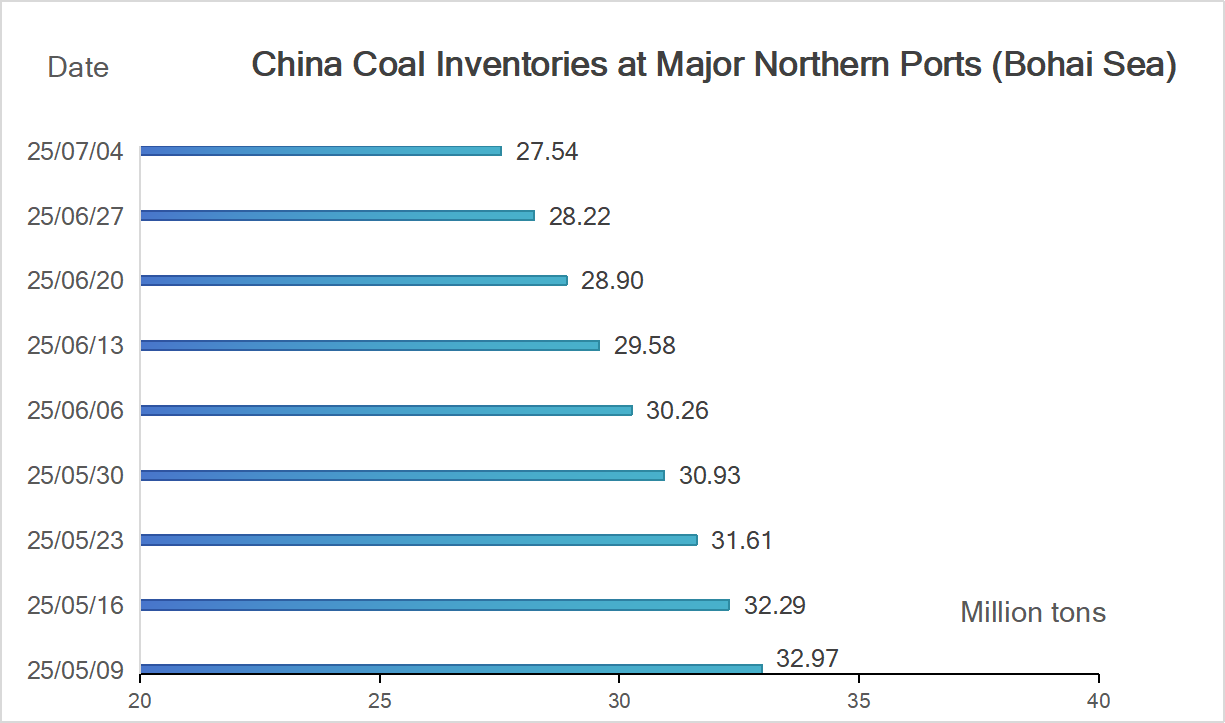

3. Northern Port Inventory Continues to Fall

Inventories at northern ports have steadily declined. CCTD data shows coal stocks at the nine major northern ports are currently around 27 million tons, nearly 6 million tons lower than previous peaks. During peak summer demand, coal outflows from these ports are expected to remain high. As production gradually resumes, coal shipments to the ports will also increase. Meanwhile, under bullish seasonal expectations, traders may become more active. Overall, both inbound and outbound volumes at northern ports may increase in early July — but if upstream supply recovery lags, inbound growth may be outpaced by outbound shipments, leading to further inventory drawdown.

CCTD China Coal Market Network is one of the most trusted coal industry think tanks in China, providing exclusive and extensive data coverage.

4. Renewable Energy's Substitution Effect on Thermal Power Strengthens

According to the National Bureau of Statistics, power generation from wind and solar increased by 11.1% and 18.3% year-on-year, respectively, during January–May. Meanwhile, green electricity consumption is also rising: the China Electricity Council reported a nearly 50% year-on-year increase in green power trading volume during the same period. As renewable generation and grid integration continue to improve, thermal power’s share in total electricity generation is expected to decline steadily, potentially limiting growth in coal demand.

Conclusion

In the short term, the coal market is influenced by both bullish and bearish factors. On the bullish side: sluggish supply recovery at production areas, strong terminal haulage, and continued inventory depletion at northern ports all support higher prices. On the bearish side: growing substitution from renewables may weigh on thermal coal demand. Overall, market fundamentals remain strong, and coal prices are likely to maintain a steady to slightly upward trend in the near term.