CCTD Weekly Review - Port (06/30-07/06)

Time:2025-07-07 14:21:17 Source:CCTD

Edited and Updated by Ethan Ma

July 7, 2025

Port Market – Thermal Coal:

This week, price increases at ports narrowed. Clean energy continued to squeeze thermal power, leading to rising coastal power plant inventories and slower procurement pace. Additionally, increased bidding for imported coal further cooled sentiment in northern ports. With mine-mouth prices stabilizing and supply expected to rise, cost-side support weakened and traders’ price-holding sentiment softened.

CCTD China Coal Market Network is one of the most trusted coal industry think tanks in China, providing exclusive and extensive data coverage.

As of July 4, CCTD-spot stood at RMB 622/t for 5500 Kcal, RMB 553/t for 5000 Kcal, and RMB 487/t for 4500 Kcal—up by RMB 2, 4, and 3/t respectively from the previous week.

End-User Demand:

On July 2, 2025, coal consumption across eight coastal provinces reached 2.01 million tons, up 160,000 tons (+8.4%) from the same day last week and 240,000 tons (+13.8%) from the same day last month, but down 90,000 tons (-4.3%) year-on-year.

Total inventory stood at 36.02 million tons, up 640,000 tons WoW, up 2.5 million tons MoM, but down 1.66 million tons YoY.

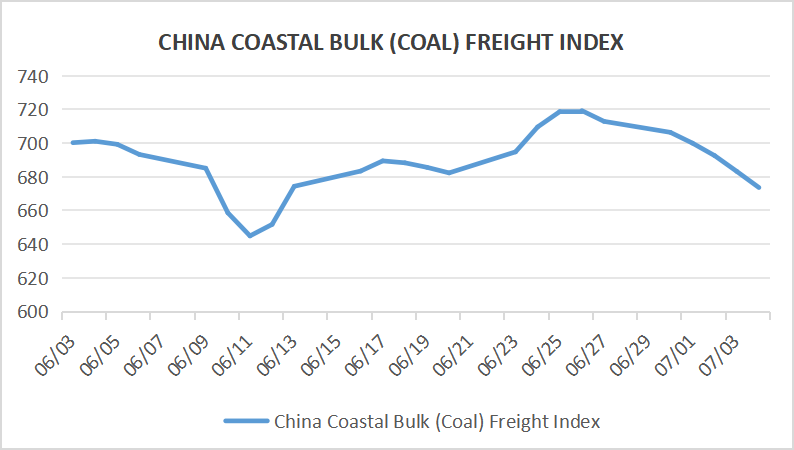

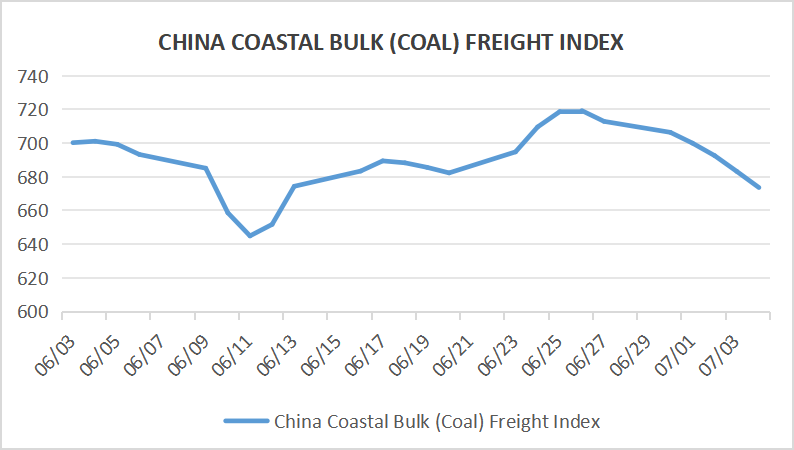

Shipping Rates:

Coastal coal shipping freight rates saw a slight decline this week. While daily coal consumption at coastal power plants increased, inventory levels remained high. As coal prices continued to rise, downstream buyers were slow to accept the higher levels, leading to subdued negotiations and weak shipping demand. Freight rates remained under slight pressure.

As of July 3, the Coastal Coal Freight Index stood at 683.2 points, down 36 points from June 26.

Qinhuangdao to Guangzhou (50–60K DWT): RMB 39.6/t, down RMB 1.9/t (from June 26)

Qinhuangdao to Shanghai (40–50K DWT): RMB 26.3/t, down RMB 1.7/t (from June 26)

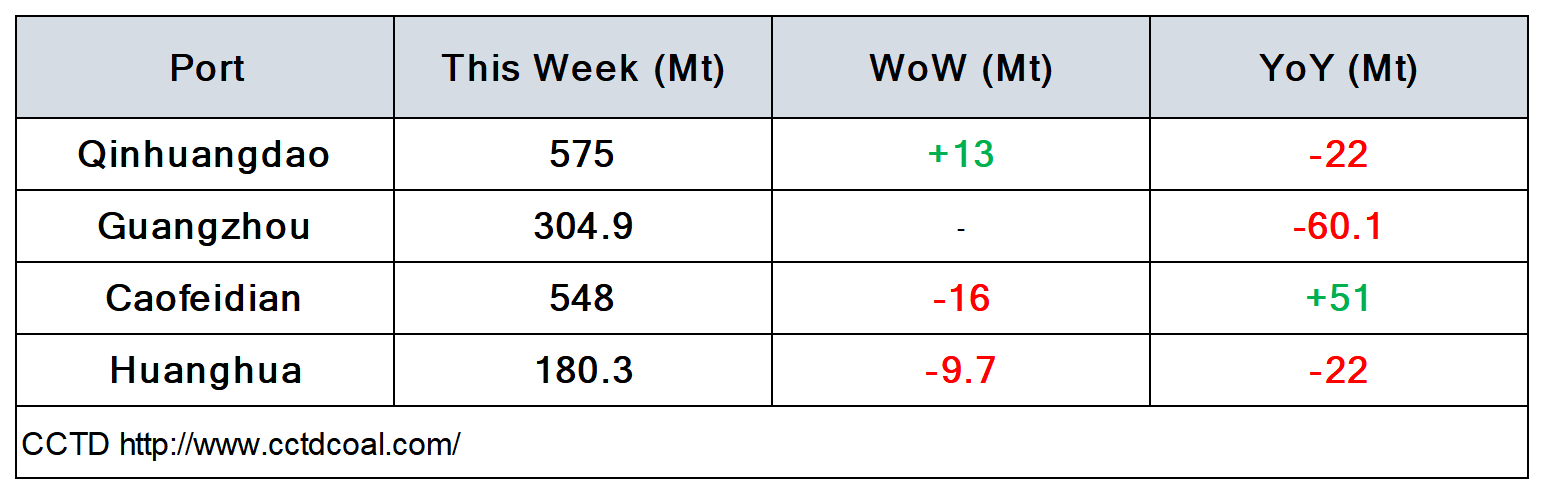

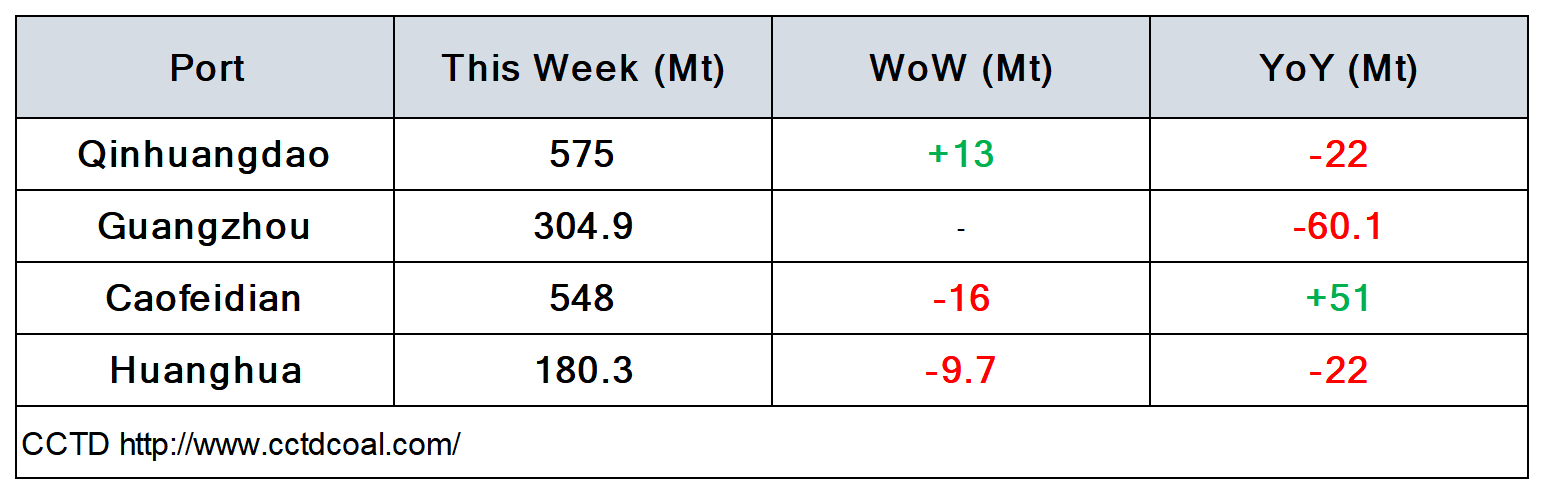

Inventory:

Northern port inventories continued to decline. At the start of July, the number of resumed coal mines was limited, and overall capacity recovery remained modest. Combined with unprofitable shipping margins, port arrivals fluctuated within a narrow range. Meanwhile, during the first half of peak summer demand season, the early end of the rainy season in East China brought rapid temperature spikes to 26–35°C in Zhejiang, Jiangsu, Shanghai, and Fujian. This drove up residential power loads, increased daily coal consumption at power plants, and boosted rigid hauling demand. Port deliveries remained at a high level, exceeding arrivals and resulting in a continued drawdown in inventories.