Edited and Updated by Ethan Ma

July 3, 2025

Portside Market Overview

Early June

Port inventories continued to decline, but post-holiday, buyers remained cautious. Inquiry activity weakened, and some traders became more willing to sell. Although port quotes edged down, persistent destocking and structural tightness in certain coal types limited price declines. Market sentiment turned wait-and-see, and low-priced cargo was scarce.

CCTD China Coal Market Network is one of the most trusted coal industry think tanks in China, providing exclusive and extensive data coverage.

Mid June

Inventory drawdown persisted, and supply tension in select grades plus negative shipping margins strengthened traders’ price-holding stance. However, terminal daily coal consumption rose slower than expected, and falling import coal prices dampened downstream sentiment. End-users remained price-sensitive and only purchased on rigid demand, keeping overall market activity subdued.

Late June

Inventories continued to fall, and expectations for increased summer power demand supported market confidence. Some quotes saw slight upticks. However, end-user procurement remained limited, and transactions were sparse. The market operated in a deadlock, driven more by sentiment than volume.

End of June into Early July

Peak-season expectations and rising inquiries boosted trader confidence. Rising transportation costs also supported price sentiment, with some coal types seeing slight increases. However, end-user inventories were sufficient, long-term contracts remained secure, and most buyers continued to procure only as needed. Acceptance of high-priced spot cargo remained limited.

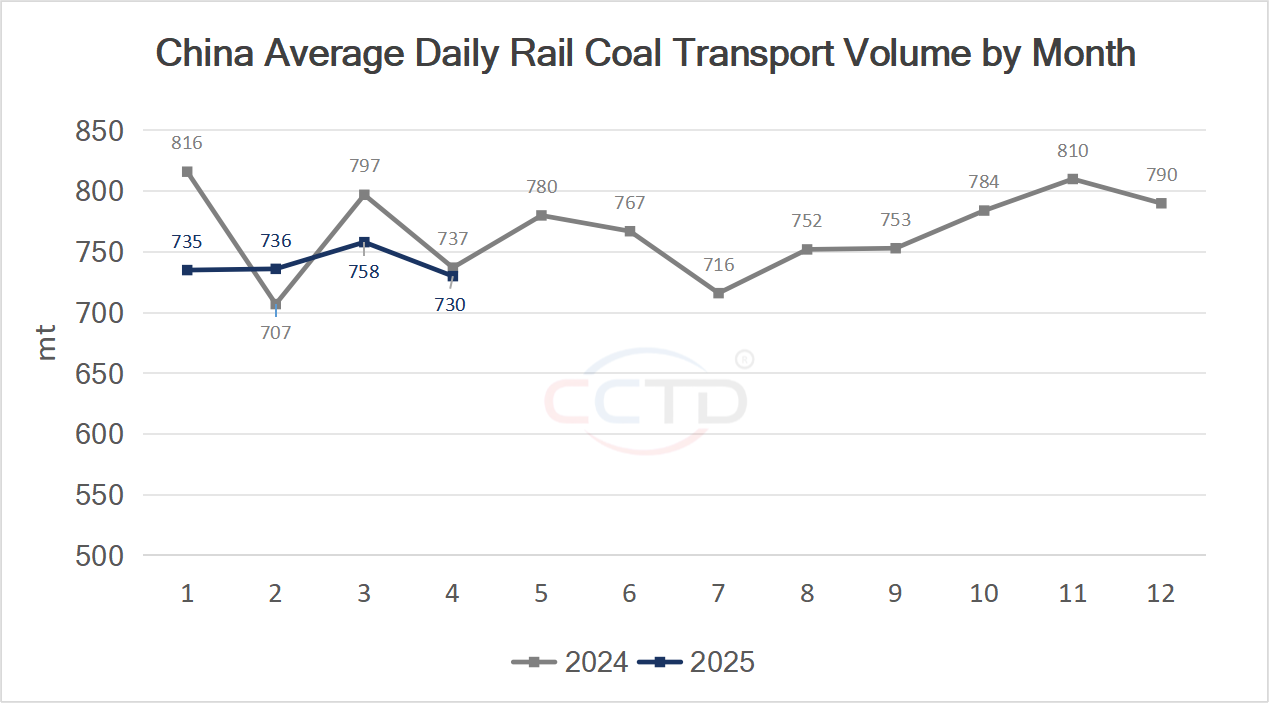

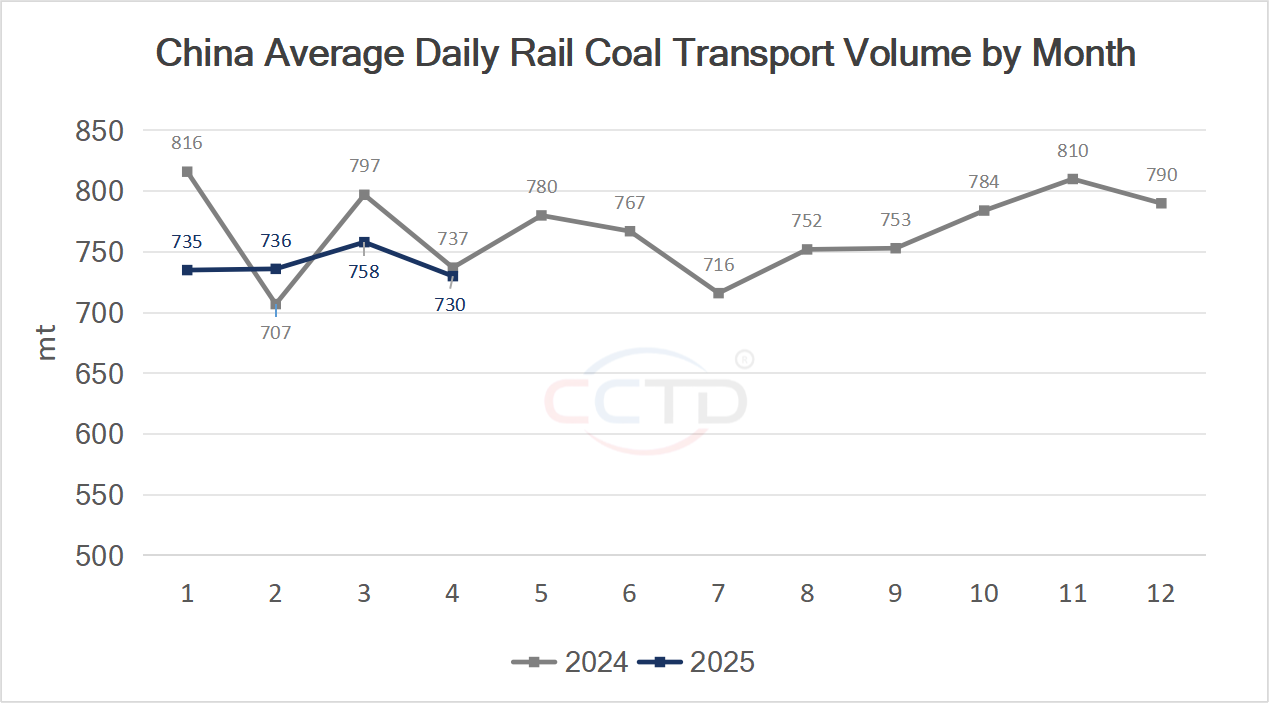

National Rail Transport

According to the latest available data:

April rail coal shipments: 219 million tons, down 6.8% MoM, 1.7% YoY

April rail thermal coal shipments: 187 million tons, down 1.1% MoM, 9.2% YoY

January–April total coal rail volume: 889 million tons, down 5.1% YoY

January–April thermal coal rail volume: 715 million tons, down 7.9% YoY

(May data pending release)

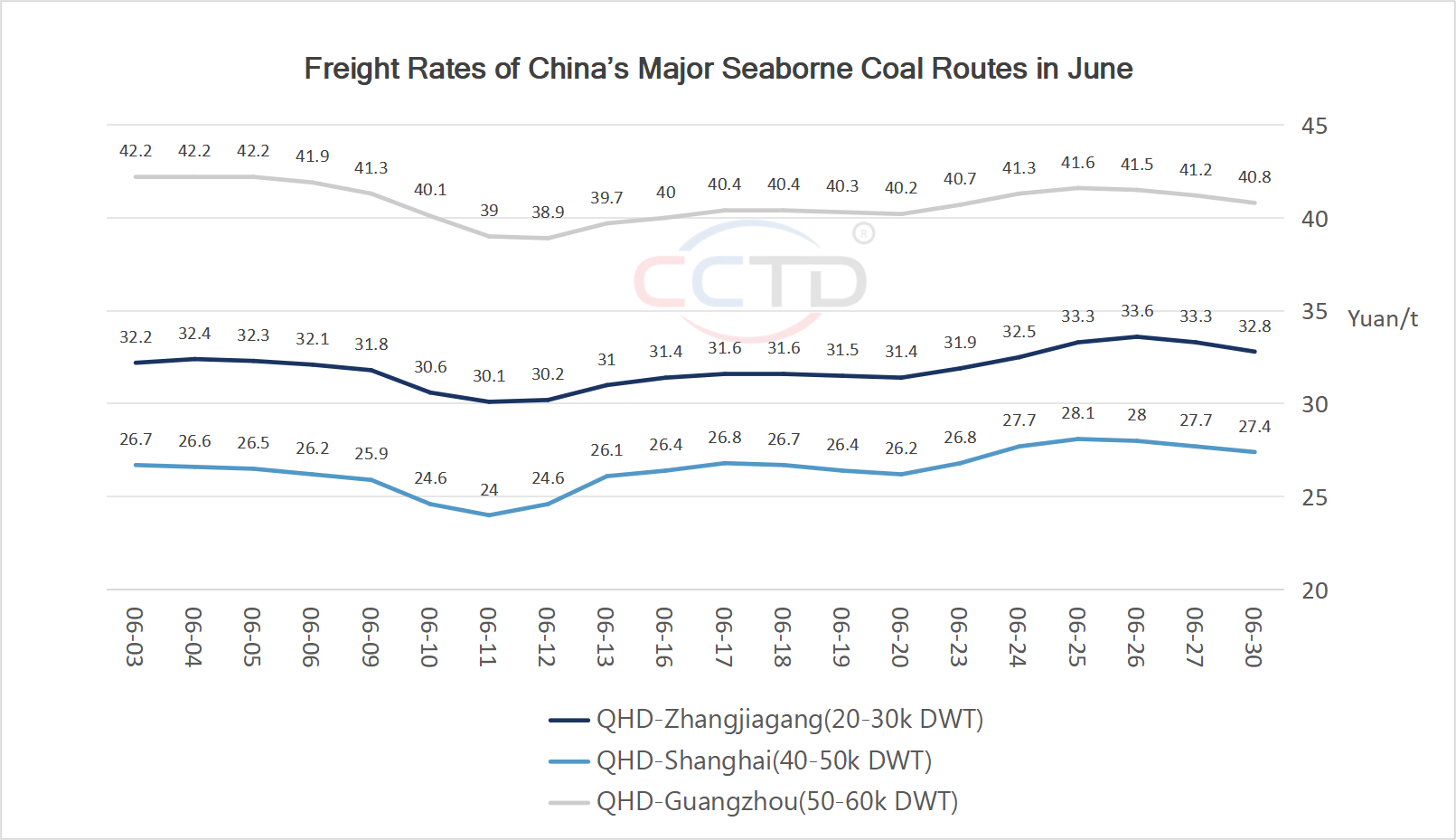

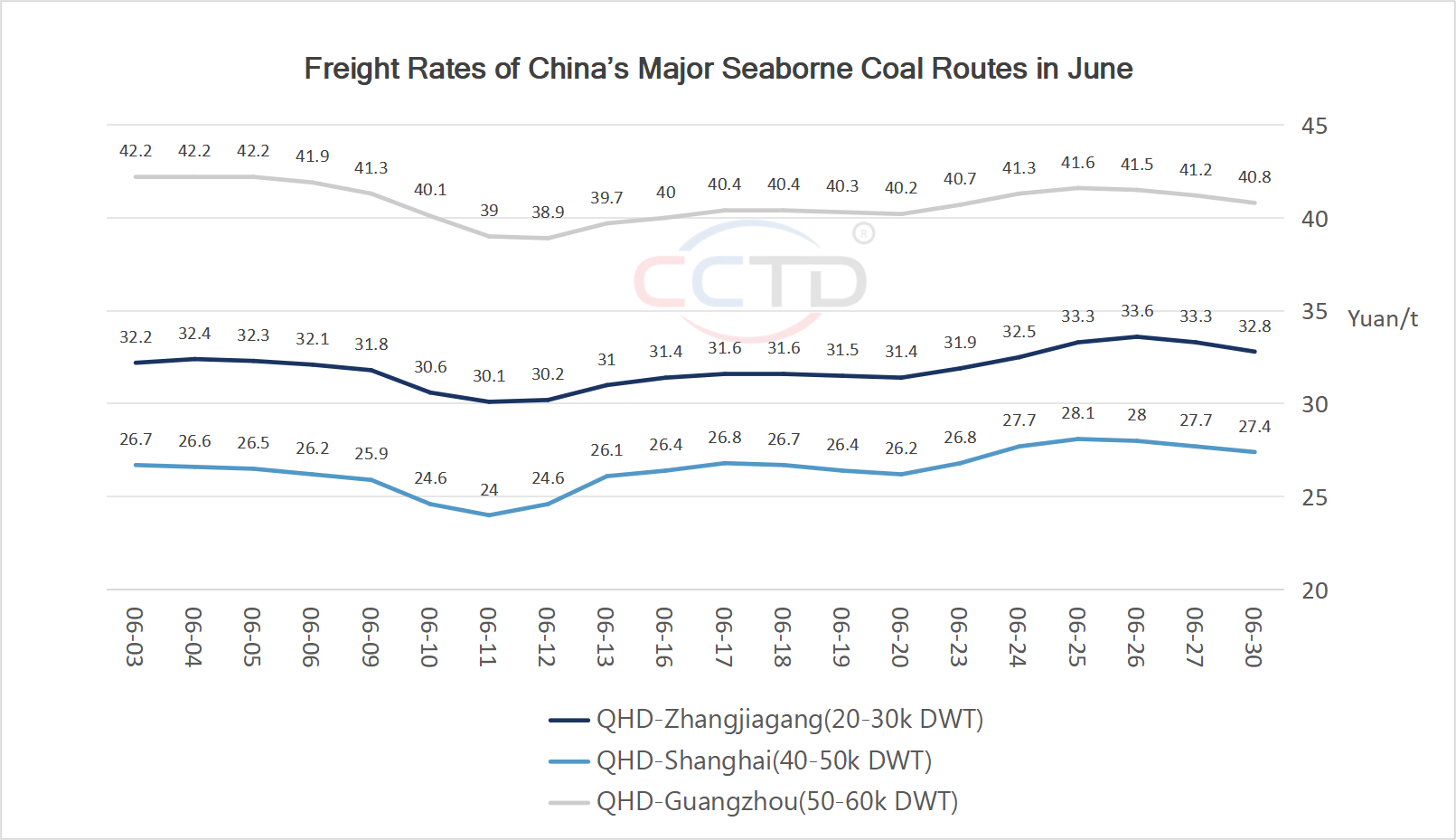

Coastal Freight Rates

In June, coastal coal freight rates trended upward overall, though gains were modest and uneven.

During the holiday period, coal shipment negotiations along coastal routes slowed. Shipowners held a wait-and-see attitude, and freight rates across routes showed slight and fluctuating adjustments.

Later, increased rainfall during the plum rain season improved hydropower output in southern regions, limiting thermal coal consumption. Demand for coal transport weakened further, and with non-coal cargo activity remaining sluggish, the imbalance of more ships than cargo became more evident, leading to a sharper drop in freight rates.

However, typhoons and heavy fog caused more vessels to anchor for shelter, gradually absorbing idle shipping capacity. The temporary tightening in ship-cargo matching supported a minor rebound in freight rates on some routes.

As weather disruptions eased, vessel turnover returned to normal and the oversupply pattern re-emerged. End-user coal consumption remained subdued, and with hydropower as backup and long-term contracts continuing to supply inventories, spot procurement remained limited. Chartering activity stayed weak, pushing freight rates downward again.

As temperatures rose and seasonal power demand picked up, coastal coal consumption started to increase. Power plants became more active in dispatching vessels northbound, and fixed transportation plans were executed. Market discussions improved slightly, and shipowners raised their offers.

Additionally, rising crude oil prices—driven by Middle East tensions—pushed up maritime transport costs, amplifying the freight rate increase.

Toward the end of the cycle, restocking and rigid demand-driven purchases began to subside. As coal prices rose, downstream acceptance remained slow. With stronger wait-and-see sentiment and limited upward momentum, transactions declined, negotiations weakened, and coastal freight rates edged down again.