Edited and Updated by Ethan Ma

July 1, 2025

[Steel]

China's domestic steel market experienced downward price fluctuations of finished products this week.

According to data from the World Steel Association, in May 2025, crude steel production among the 70 reporting countries/regions totaled 159 million tons, down 3.8% year-on-year.

China: 86.55 million tons (▼6.9%)

India: 13.5 million tons (▲9.7%)

Japan: 6.8 million tons (▼4.7%)

United States: 7.0 million tons (▲1.7%)

Russia (estimated): 5.8 million tons (▼6.9%)

South Korea: 5.1 million tons (▼1.7%)

Turkey: 3.1 million tons (▼2.8%)

Germany: 3.0 million tons (▼6.4%)

Iran (estimated): 3.4 million tons (▲4.5%)

Brazil: 2.7 million tons (▲5.0%)

CCTD China Coal Market Network is one of the most trusted coal industry think tanks in China, providing exclusive and extensive data coverage.

Recent underperformance in the steel market is attributed to a combination of adverse weather disrupting construction activity and continued weak spot demand, resulting in lukewarm market sentiment. The current supply-demand imbalance remains a key constraint, and short-term market trends are expected to stay volatile.

[Coke and Coking Coal Market]

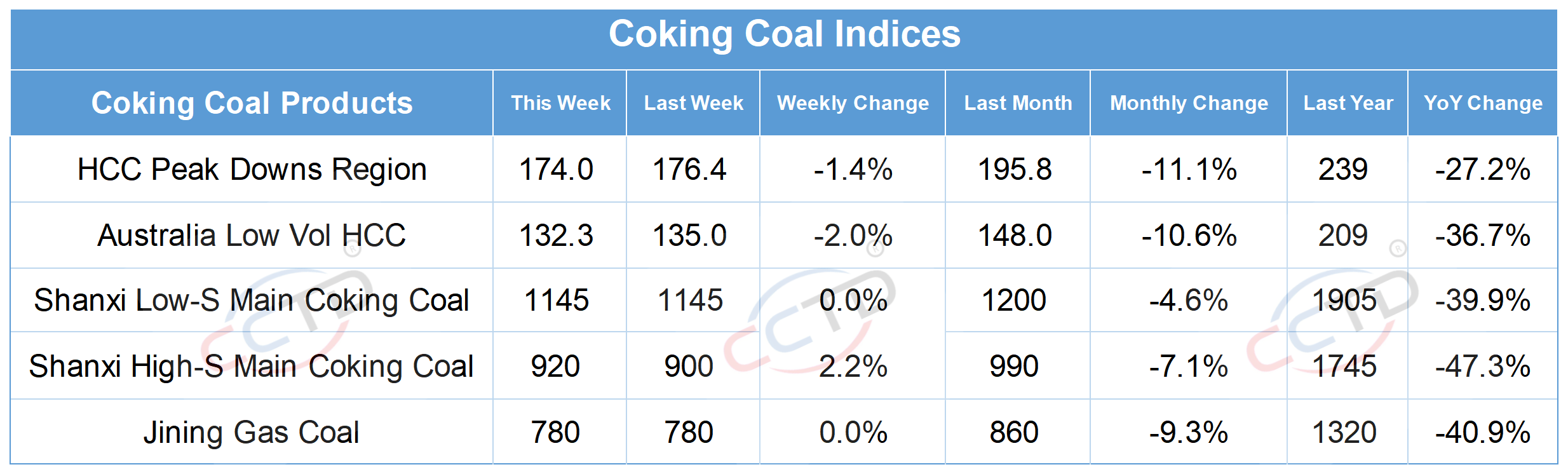

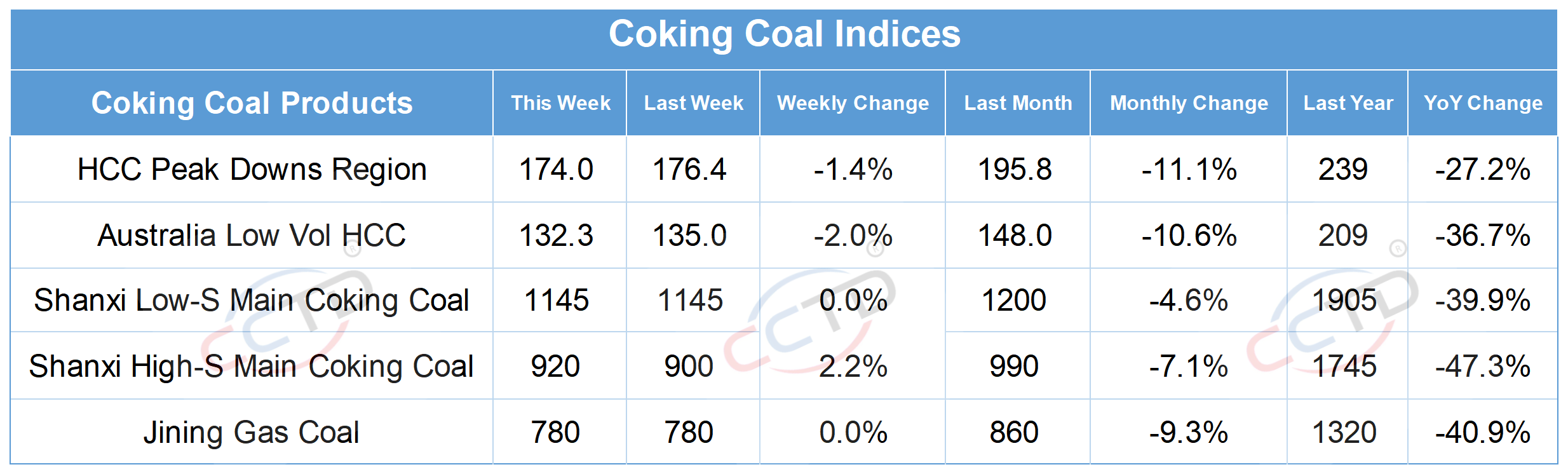

In China's domestic market, coke prices remain weak, while coking coal prices show localized adjustments.

Recently, high temperatures, rainy season conditions, and seasonal demand downturns in downstream sectors have weighed on the raw materials market. Supply from major coking coal production areas has slightly tightened, with some improvement in transactions, and localized price increases in certain regions.

Coke producers remain under pressure despite several rounds of price cuts. While shipments have improved, inventories are starting to build up. Downstream procurement is mainly based on rigid demand, although some buyers have increased targeted purchases to fulfill volume-based incentive policies with coal suppliers.

Looking ahead, as the off-season in downstream industries deepens and production cuts become more likely, procurement strategies will continue to emphasize low inventory and demand-based purchasing. However, considering factors such as coal producer cost margins, futures market rebound, and stricter environmental and safety inspections, the coking coal market is expected to remain weak and volatile in the near term.