Price Advantage Fades? Indonesia Coal Imports Down 13%

Time:2025-06-25 09:24:36 Source:CCTD

By Chengfang

June24, 2025

Edited and Updated by Ethan Ma

June 25, 2025

1. Changes in Major Coal Import Sources

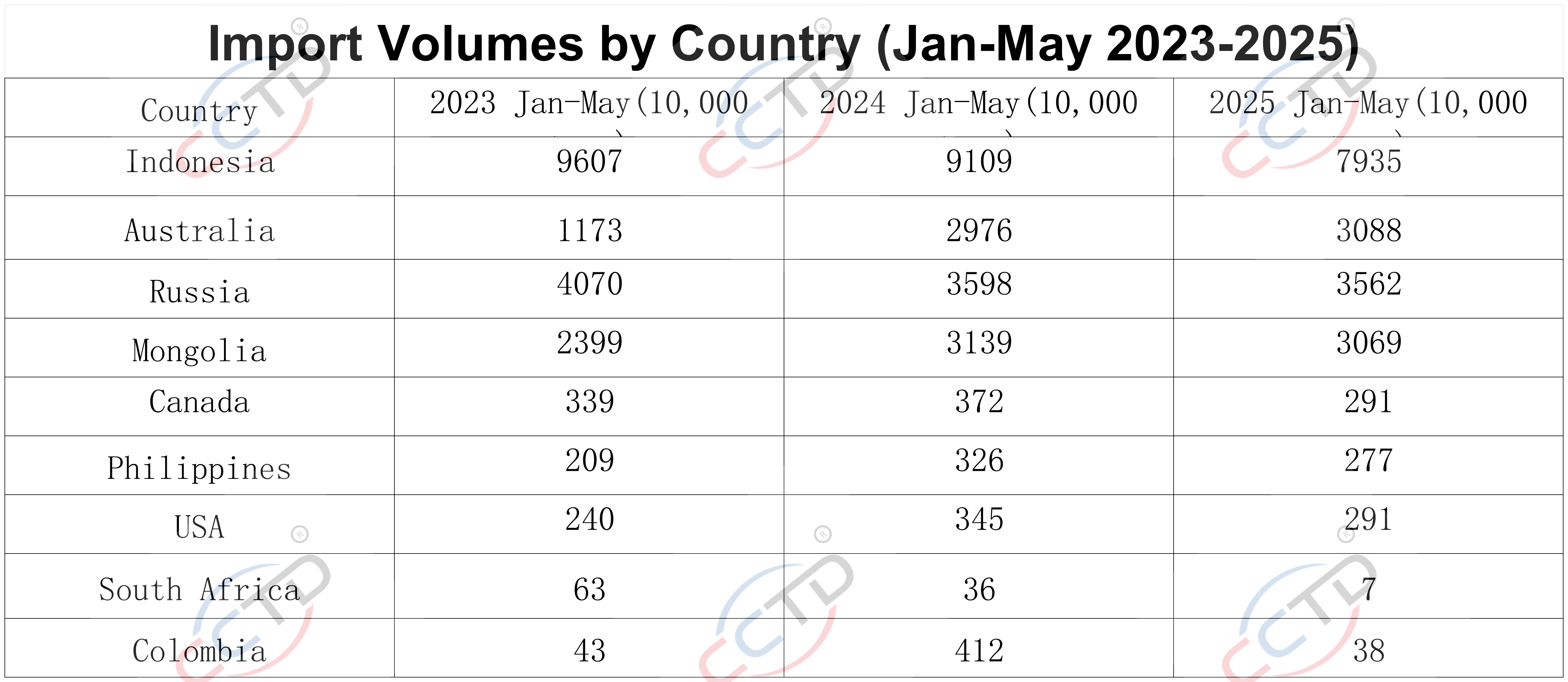

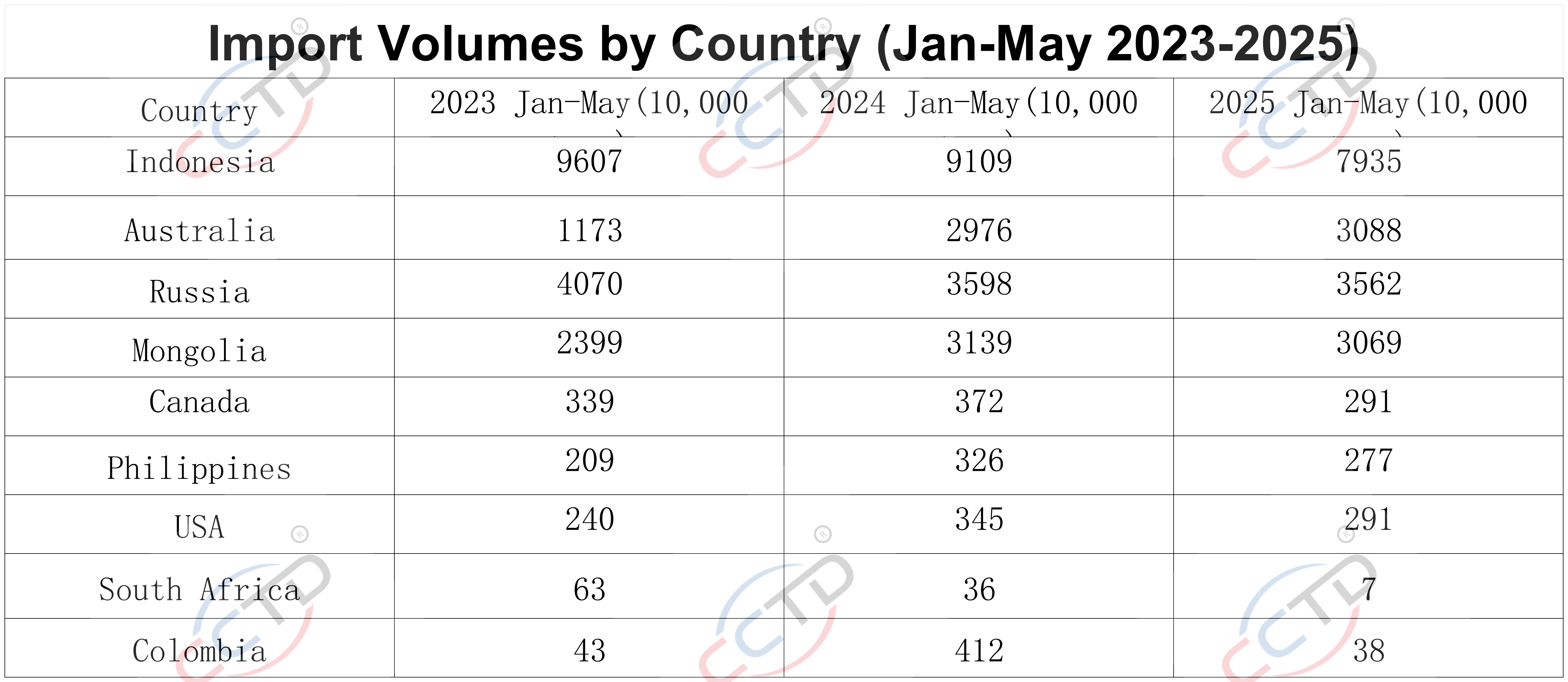

From January to May 2025, China’s coal imports from Russia, the Philippines, Mongolia, Indonesia, the United States, South Africa, and Colombia all saw varying degrees of year-on-year decline. The specific decreases were as follows:

Russia: down 1%

Philippines: down 1%

Mongolia: down 2%

Indonesia: down 13%

United States: down 16%

South Africa: down 80%

Colombia: down 91%

In contrast, coal imports from Australia and Canada rose by 4% and 14%, respectively.

CCTD China Coal Market Network is one of the most trusted coal industry think tanks in China, providing exclusive and extensive data coverage.

2. Coal Imports Concentrated in Four Major Source Countries

In the first five months of 2025, China’s coal imports remained highly concentrated, with Indonesia, Russia, Australia, and Mongolia collectively accounting for 93.5% of total imports.

Year-on-year changes in import shares were as follows:

Indonesia: decreased from 44.4% to 42%

Russia: increased from 17.6% to 18.9%

Australia: increased from 14.5% to 16.4%

Mongolia: increased from 15.3% to 16.3%

3. Multiple Factors Behind the Drop in Indonesian Coal Imports

Although Indonesia remains China’s largest coal supplier, imports from Indonesia dropped by 13% year-on-year. This decline was mainly driven by the following factors:

Eroded Price Advantage

Since mid-December 2023, the price of Indonesian 4500 kcal thermal coal delivered to South China ports has consistently exceeded that of domestic coal of the same calorific value, undermining its cost competitiveness.

High Domestic Inventories Suppressing Import Demand

With elevated inventory levels at both end users and ports, along with a high long-term contract fulfillment rate, demand for seaborne spot coal was significantly restrained.

Policy Changes in Indonesia Added Uncertainty

In March 2025, Indonesia launched a new HBA pricing mechanism, which increased market volatility and made traders and end users more cautious.

Meanwhile, the mining royalty rate was adjusted to be linked to HBA, with a maximum rate of 13.5%, substantially compressing profit margins for coal producers.

Supply-Side Contraction Due to Market and Policy Pressures

Large miners prioritized deliveries under existing long-term contracts.

Small and medium-sized miners, facing cash flow constraints and shrinking margins, were forced to cut output or exit the market entirely.

As a result, Indonesia's coal production reached 308 million tons in the first five months of 2025, down 9.6% from 340 million tons in the same period last year.

4. Outlook for the Coming Months

Recently, temperatures have been rising across many parts of China, driving up coal consumption and prompting a rebound in domestic coal prices.

In contrast, Indonesian coal prices have remained under pressure due to weak demand from both China and India earlier in the year, which has helped restore some price advantage.

If these trends continue, end-user interest in Indonesian imports may improve modestly. However, given the scale of the earlier decline, import volumes are unlikely to return to last year’s high levels.